Tax Day 2017: Where does Illinois’ $38.1 billion in tax revenue come from?

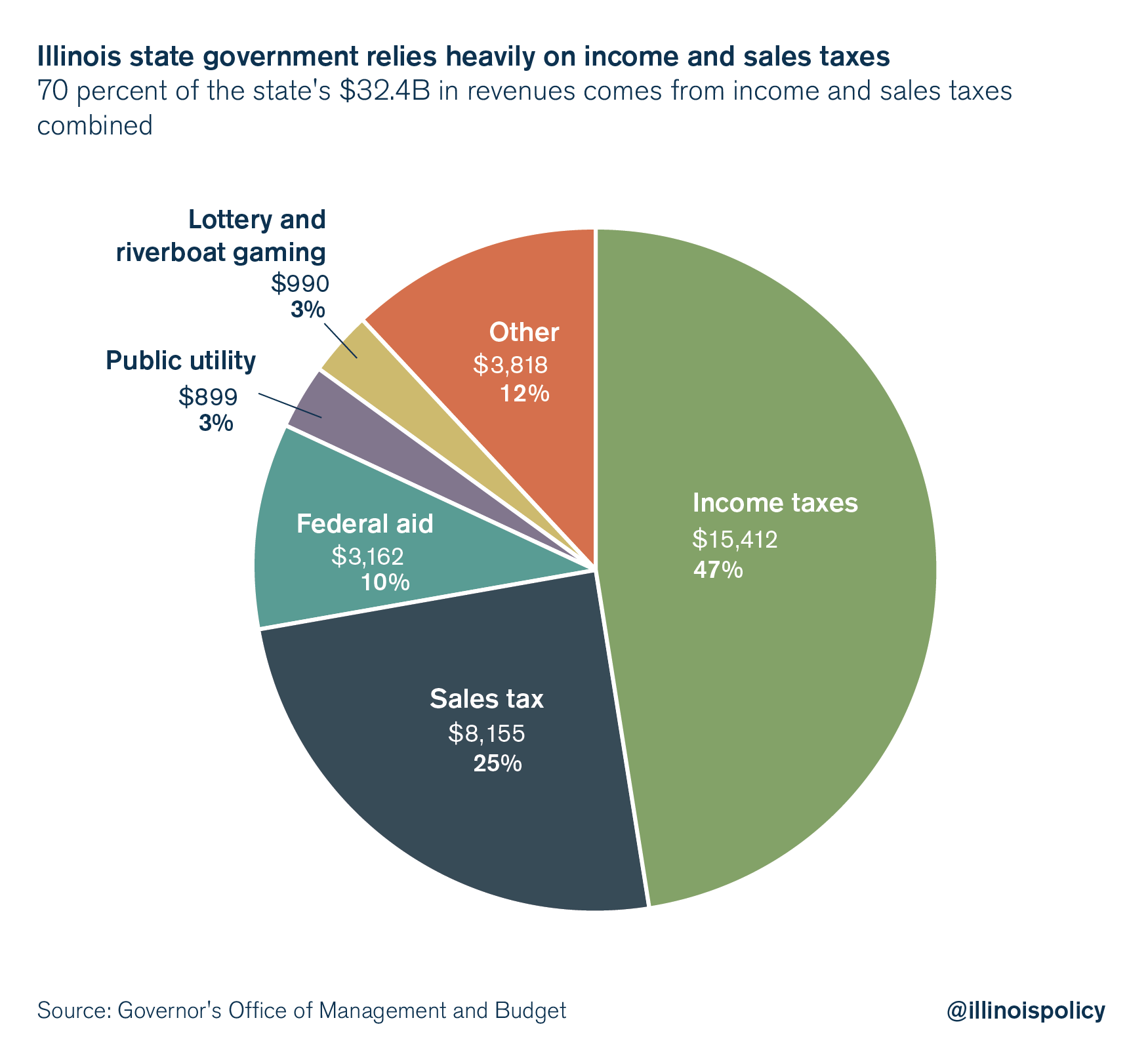

About two-thirds of state revenue comes from income and sales taxes.

The deadline to file state and federal income taxes is April 18, but for Illinoisans the sting of Tax Day is year-round. Residents in the Land of Lincoln face the highest overall state and local tax burden in the nation.

And in 2017, Illinois state government expects to spend $38.1 billion in 2017 – $5.7 billion more than the revenues it will collect, according to data from the Governor’s Office of Management and Budget.

Where does the money come from?

The bulk of the state’s money comes from income and sales taxes. Combined, these taxes account for over 70 percent, or $23.6 billion of the $32.4 billion state government collects.

Twelve percent of state revenues come from taxes on cigarettes, liquor and insurance sold in Illinois, totaling $3.8 billion in 2017.

Another 3 percent comes from the net proceeds of the state’s lottery as well as taxes on the profits of gaming river boats and casinos in Illinois – about $1 billion this year.

Public utility taxes on electricity, telecommunications and natural gas companies accounts for another 3 percent of state revenue collected.

The last 10 percent is received from the federal government. The state expects $3.2 billion in reimbursements from the federal government in 2017, primarily to help fund Medicaid.

In all, the state will collect more than $32.4 billion in 2017, or about $3.6 billion less than the peak $36 billion when Illinois’ temporary tax hike was in place.

More money than ever

Any way you measure it, Illinois governments already collect more than enough money from taxpayers. Illinoisans pay the highest property taxes in the nation, and when total state and local taxes are tallied up, Illinoisans face the highest overall tax burden in the nation. Illinoisans can’t afford to pay more taxes.

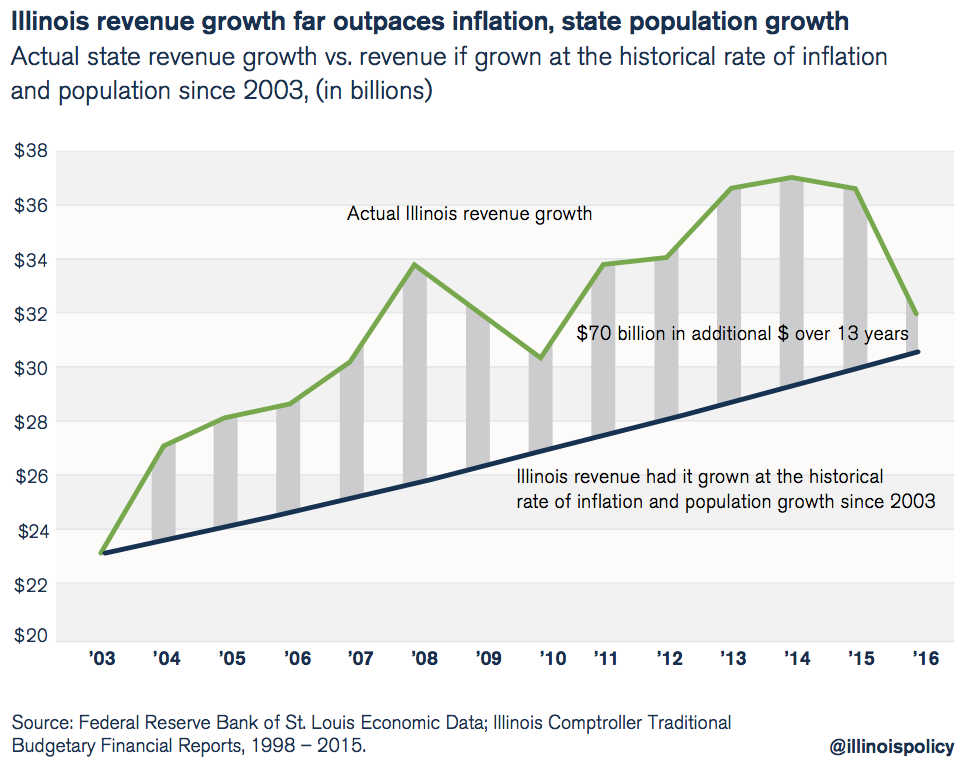

From 2003 to 2016, Illinoisans paid $70 billion more in taxes than the state would have collected had revenues grown at the rate necessary to cover inflation plus population growth.

But politicians didn’t use that excess money to pay down pensions or debt. Instead, they used it to prop up higher spending on government-worker benefits.

Some politicians are calling for another income tax hike. But as the numbers show, Illinoisans are already shelling out a pretty penny – and the General Assembly hasn’t proved itself capable of managing the money.