The proof is in the GDP: Illinois needs to grow its tax base, not its tax rate

Illinois’ economy lagged the national average between 2003 and 2014. Had Illinois’ gross domestic product grown at the same pace as the national average since 2003, Illinois workers would have generated an additional $64.6 billion in products and services in 2014.

Illinois House Speaker Michael Madigan seems to believe the only way to generate money for government programs is to raise the income-tax rate. In other words, Madigan and like-minded politicians in Springfield want to take a bigger bite out of Illinois workers’ paychecks.

But there’s a better path forward for Illinois: Grow the tax base, not the tax rate.

Growing the state’s tax base would mean creating a drastically different economic climate – one that would attract employers and workers alike. This will require a lot of effort: Today, Illinoisans are struggling through one of the worst economic recoveries in the nation, people and businesses are leaving, and they are taking their money with them. Illinois’ failed policies of the last decade – namely, increasing taxes and overspending – are shrinking the tax base. This has left Illinois with an economy that lags behind those of most other states.

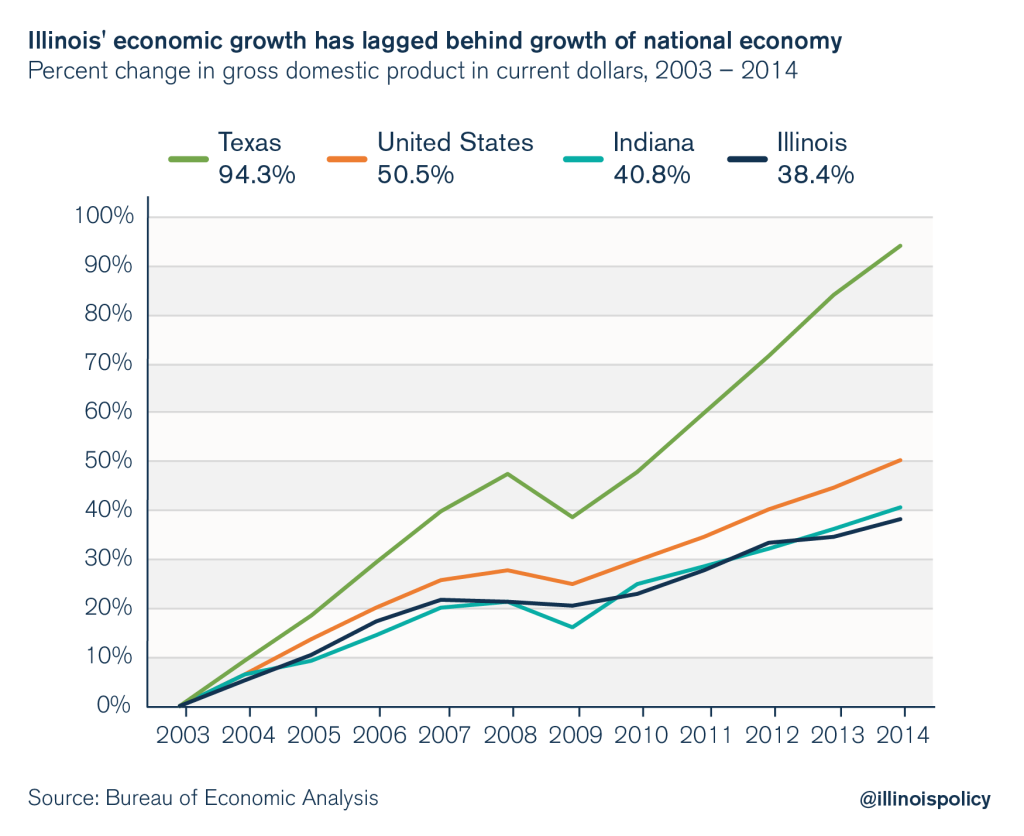

Consider the best indicator of Illinois’ economic growth, the gross domestic product. The GDP measures the total amount of goods and services created. When the GDP is rising, the economy is going in the right direction; when the GDP is dropping, the economy is not performing as well. Economists view it as the single most informative piece of information on the economy as a whole.

From 2003 to 2014, a decade when Madigan virtually controlled state government with majorities in both legislative chambers and Democratic governors, Illinois’ GDP grew by only 38.4 percent, according to data from the U.S. Bureau of Economic Analysis, or BEA. By comparison, U.S. GDP grew by 50.5 percent during that time.

Illinois ranked 41st in the U.S. for the 2003-2014 period, according to BEA information Compare Illinois’ performance with that of Texas, a high-growth state, which ranked 3rd with 94.3 percent growth. And neighboring Indiana also beat Illinois with a 40.8 percent growth rate in GDP.

Low growth has meant fewer opportunities for Illinoisans.

If Illinois’ economy had grown at the same pace as the national average since 2003, Illinois workers would have generated an additional $64.6 billion in products and services in 2014, pumping more life into the state’s economy and sending more tax revenue to state coffers. And if Illinois had grown like Texas since 2003, Illinois’ economy would have been nearly one-third larger in 2014 alone. Even at Indiana’s pace of growth, Illinois’ economy would have been better off by $12.7 billion in 2014.

Instead, Illinois has been stuck with bad policies followed by a bad economy.

But there is no reason Illinois can’t adopt better policies to cultivate a strong economy.

If Illinois becomes a friendlier place to do business, more businesses will open. And those additional businesses will hire more workers. And more workers will earn income and pay taxes, resulting in more revenue to pay for core government services. All this can happen without politicians reaching into taxpayers’ wallets for a larger share of Illinoisans’ hard-earned money.

Illinoisans need to demand policies that grow the tax base, not tax rates. These policies include:

- Lowering the cost of government by creating a more realistic retirement plan for state workers

- Demanding a truly balanced budget to ensure spending doesn’t outpace revenues

- Reforming Illinois’ workers’ compensation system to be more in line with those in other states

- Reducing the overall property-tax burden to make Illinois more affordable