Report: Illinois’ budget health is the worst in the nation

A new university study ranks Illinois last of all 50 states for fiscal health. Pension reform and spending caps are essential for recovery.

Illinois has the worst fiscal health in the nation, according to a new study from the Mercatus Center at George Mason University. The report is another mark against the Prairie State, which consistently ranks among the worst in the nation on a range of indicators by numerous research organizations.

The study ranks states across five measures of fiscal solvency. Illinois ranked 50th overall and performed poorly across the board:

- On the ability to cover short-term bills with money on hand, Illinois ranked 49th

- On the ability to cover annual expenses with annual revenues, Illinois ranked 46th

- On the ability to cover future commitments and weather fiscal shocks, Illinois ranked 49th

- On the major long-term liabilities of pensions and government worker health insurance, Illinois ranked 46th

- On governments’ ability to raise taxes without harming the economy, Illinois ranked 14th

The fifth measure is out of date, because it used fiscal year 2016 – before state lawmakers passed the 2017 state income tax hike. Illinois’ ranking today would likely be much lower.

Mercatus reports Illinois consistently performs poorly because of ongoing structural deficits, a growing reliance on debt to fund spending, and massive debts for government worker health insurance and pensions – among other problems. The report also highlights Illinois’ worst-in-the-nation pension crisis, noting that unfunded pension liabilities have grown to 67 percent of state personal income in fiscal year 2016, up from 22 percent in fiscal year 2006.

Illinois’ last-in-the-nation fiscal solvency ranking comes shortly after the state set a record for its pension-debt-to-state-revenue ratio, at 601 percent, according to Moody’s Investors Service. Illinois was also found to be one of the least prepared states for the next recession by both S&P Global Ratings and Moody’s Analytics.

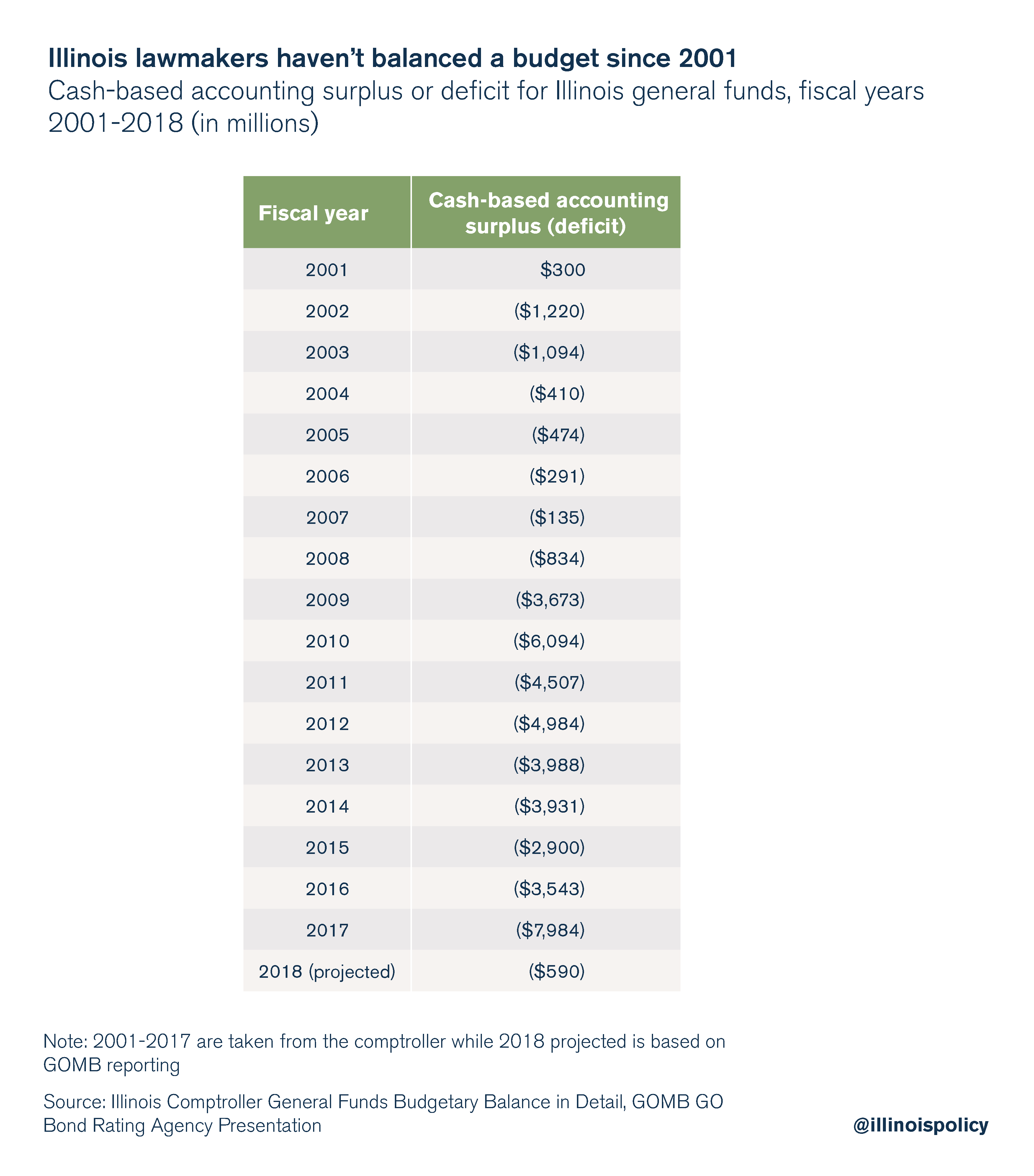

Unfortunately, bad budget news is nothing new for the state. Illinois has not had a truly balanced budget since at least 2001.

The state’s nearly two decades of unbalanced budgets stem from a bad budgeting process and overpromised pension benefits that are growing far faster than taxpayers’ ability to pay for them.

Fixing Illinois’ fiscal mess will require deep structural reforms to tackle the cost drivers of the state’s overspending, including meaningful pension reform to future unearned benefits and a spending cap that ties lawmakers’ ability to spend to taxpayers’ ability to pay.

The Mercatus report should spur Illinois to action: With some economists predicting a recession could be on the horizon, Illinois must start righting its fiscal ship to better weather the next storm.