Yingling stands with Illinois taxpayers against progressive income tax hike

State lawmakers should follow state Rep. Sam Yingling’s example, and muster the courage to reject the $3.4 billion tax hike proposal.

Gov. J.B. Pritzker’s push for a progressive income tax has been a hallmark of his first term. But the more Illinoisans have learned about the proposal, the more momentum has built against it.

State Rep. Sam Yingling, D-Grayslake, is the latest member of the Illinois House of Representatives to publicly oppose the ill-considered income tax overhaul. “The current proposals do not adequately address the crushing burden that our property tax system places on homeowners,” Yingling wrote in a May 8 letter to the Chicago Tribune. “I will be a ‘no’ vote unless adoption of a progressive income tax ends the state’s regressive and abusive property tax system.”

Yingling is correct to point out a key flaw in Pritzker’s progressive income tax plan. It fails to address Illinoisans’ crushing property tax burden.

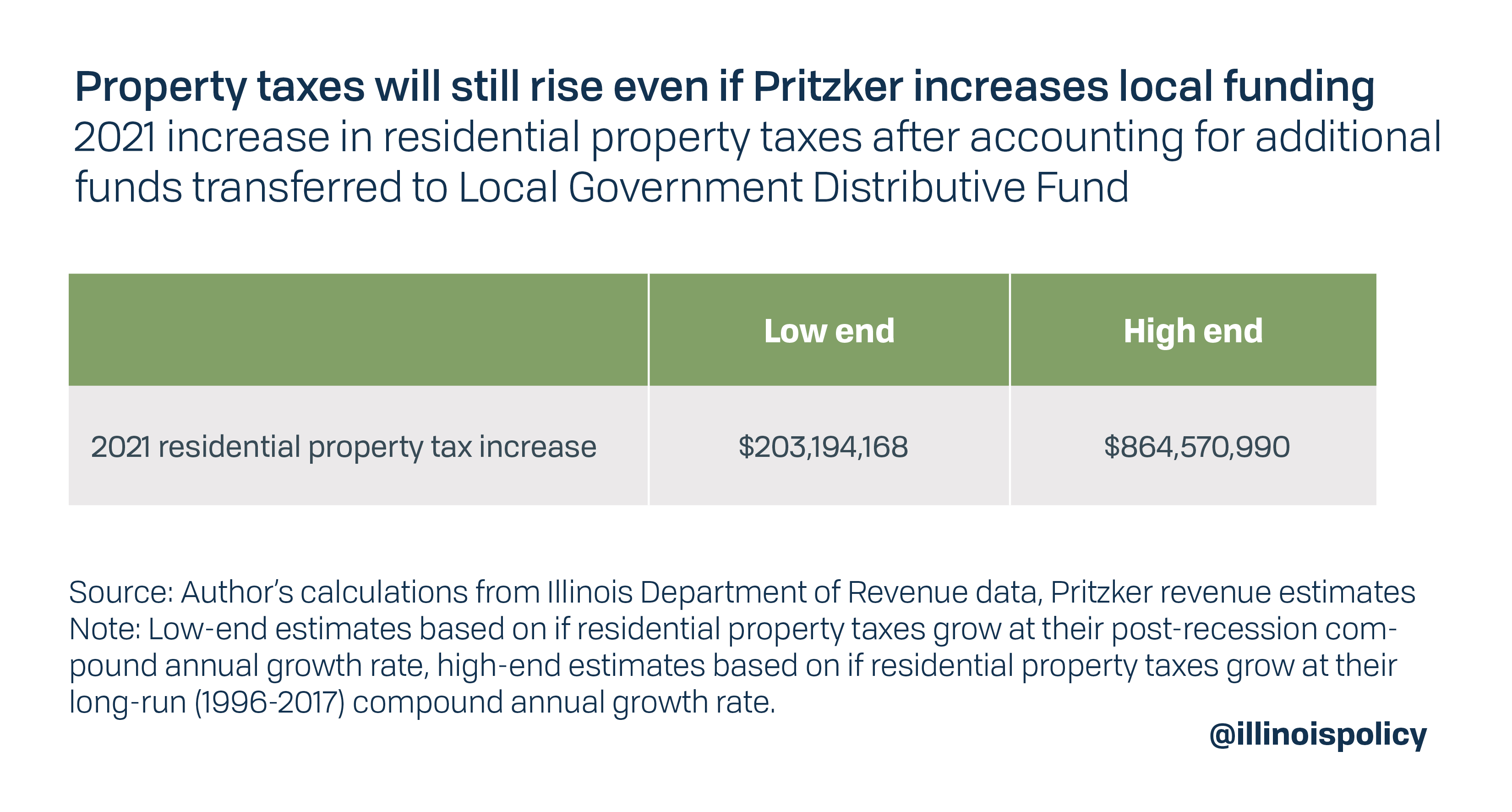

While Illinoisans pay the second-highest property taxes in the nation, the governor’s plan for a progressive state income tax does nothing to address some of the biggest cost drivers for both state and local governments: pensions and government worker health insurance. Without reforms to those costs, property taxes are likely to continue rising and Illinoisans will see little to no tax relief from Pritzker’s plan.

Further, polling data show that in at least six Illinois House districts represented by Democrats, likely voters oppose Pritzker’s plan.

While middle-class tax relief was Pritzker’s central promise in campaigning for what he has dubbed the “fair tax,” the governor recently abandoned that promise. “As you know, we currently live in a system in which the taxes can be changed at any moment so there’s certainly no guarantees,” Pritzker said in an April 23 interview with ABC 7. “But what I will tell you is that I am fighting for the plan that I put forward.”

Pritzker first invited skepticism of his “fair tax” plan when he unveiled his proposed ratesMarch 7. While the governor’s team boasted $3.4 billion in projected revenue, neither Illinois Policy Institute nor Civic Federation analyses have been able to replicate that estimate.

On May 1, the Illinois Senate passed a proposed amendment that would allow lawmakers to scrap Illinois’ flat tax protection and pass additional income taxes on the same dollar earned. The amendment was also packaged with proposed tax rates that differed slightly from Pritzker’s initial proposal, allowing for the nation’s highest tax on business income.

Notably, Democrat state Sens. Jennifer Bertino-Tarrant, D-Plainfield; Tom Cullerton, D-Villa Park; and Suzy Glowiak, D-Western Springs, each voted against the companion bill that included the new rates. In fact, by Senate Democrats’ own numbers, the proposal would fall $175 million short of Pritzker’s goal of closing the state’s $3.2 billion anticipated budget shortfall.

But this doesn’t even account Pritzker’s ambitious spending promises, which would require the typical Illinois family ultimately pay up to $3,500 more in income taxes.

The reality is that scrapping Illinois’ flat income tax protection would be a bridge to tax hikes on the middle class.

Unfortunately, the governor claims there only two ways for Illinois to climb out if its fiscal hole: massive tax hikes or slashing core government services such as education, public safety and social services. That’s not true. State leaders must pursue structural spending reforms to protect Illinoisans from both austere service cuts and punishing tax hikes.

Illinois House lawmakers should follow Yingling’s example and muster the courage to reject a reckless tax proposal that would worsen Illinoisans’ tax burden while leaving the state’s most pressing fiscal problems unaddressed.

Topics on this page

Sign the petition

Stop the progressive income tax

Sign the petition today to tell your lawmaker to oppose the progressive income tax.

Learn More >