Defending the indefensible: IMRF director on pensions

The head of the Illinois Municipal Retirement Fund, or IMRF, has dismissed calls for pension reform, disregarding the fact that pensions aren’t manageable, benefits aren’t affordable, and previous “reforms” propped up pensions on the backs of new workers.

If Illinois collapses economically in the next few years, outrageous pension costs – and politicians’ failure to fix them – will be the reason.

So when lawmakers and public officials try to dissuade Illinoisans from pursuing pension reform, it’s outrageous. In a Dec. 19 Crain’s Chicago Business editorial, “Beware the siren call of ‘pension reform,’” Louis Kosiba, head of the Illinois Municipal Retirement Fund, or IMRF, wrote:

“There continues to be a call for pension reform at the state level and for the City of Chicago and Cook County. As the executive director of the Illinois Municipal Retirement Fund, I think that is misleading.”

It is irresponsible to dismiss pension reform. Millions of Illinoisans affected by the pension crisis could tell Kosiba why.

Pensioners are worried about their collapsing retirement security. Younger government workers are forced to contribute to a pension system that may never pay them benefits. Taxpayers, who now pay the highest property taxes in the nation, contribute more and more each year toward increasingly insolvent pension funds. Many are being squeezed out of their homes in retirement, while others are forced to leave their homes for other states. And Illinois’ most vulnerable have seen vital services cut to make room for growing pension costs.

Twenty years ago, state worker pensions consumed just 3 percent of the state budget. Today, that burden is nearly 25 percent.

That same budget stress is occurring in most Illinois municipalities and local governments. The city of Chicago and Chicago Public Schools, both junk-bond rated, are approaching bankruptcy, as are many of the state’s 650 municipal police and fire pension funds.

Kosiba has it exactly wrong: The real siren song tempts people to dismiss the need for pension reform.

Here’s the truth about IMRF and the state’s broken pension systems.

- IMRF is not a model for other state pensions

Kosiba touts IMRF as the model for how Illinois pension funds should be run. In particular, he notes IMRF has something no other Illinois spending program has – guaranteed funding.

Cities are mandated, through a court-enforced funding guarantee, to fund IMRF pensions above everything else. That means cutting funding for road repair, libraries and police and firefighter pensions or raising taxes on struggling residents to make room for rising pension costs.

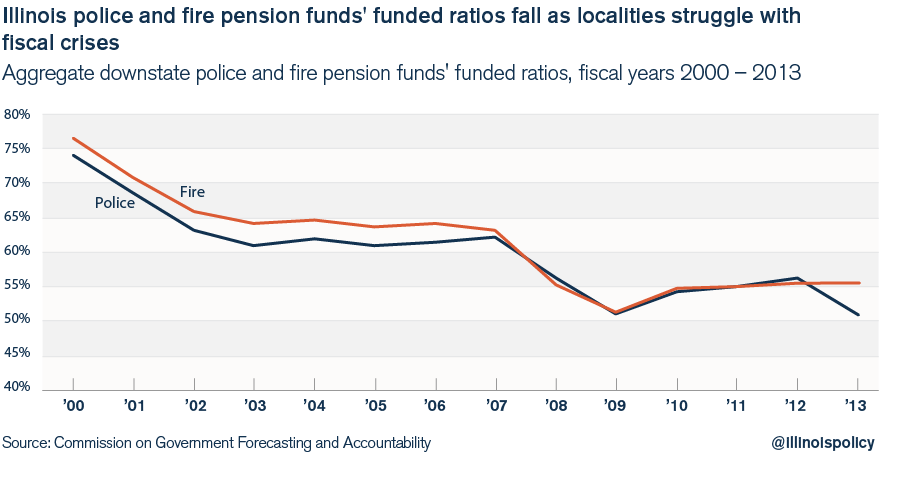

Since 2000, the funding levels of police and firefighter pensions have fallen by 20 percentage points. Collectively, the two systems have little more than half the money needed today to pay out future benefits.

The funding guarantee for IMRF drains the life out of taxpayers and thousands of local governments to ensure IMRF pensions get funded. It puts taxpayers, regardless of their ability to pay, on the hook for every failure of the pension fund, whether it’s bad investments or overly generous government-worker benefits.

And as pension costs have risen, so have property taxes. Illinoisans pay the highest property taxes in the country, and in many cities, pension costs consume almost every penny.

The city of Springfield, for example, now dedicates 100 percent of its city property taxes to pay for its police, firefighter and city-worker pensions.

Other cities have raised taxes and fees to combat rising pension costs. Peoria has added water and natural gas utility taxes, and also has doubled its garbage-collection fees to help fund its growing pension commitments.

IMRF’s funding method is not a model plan for the rest of Illinois. It would push the state and the city of Chicago to insolvency and do nothing to solve the pension systems’ fundamental problems.

- Local pension costs aren’t manageable

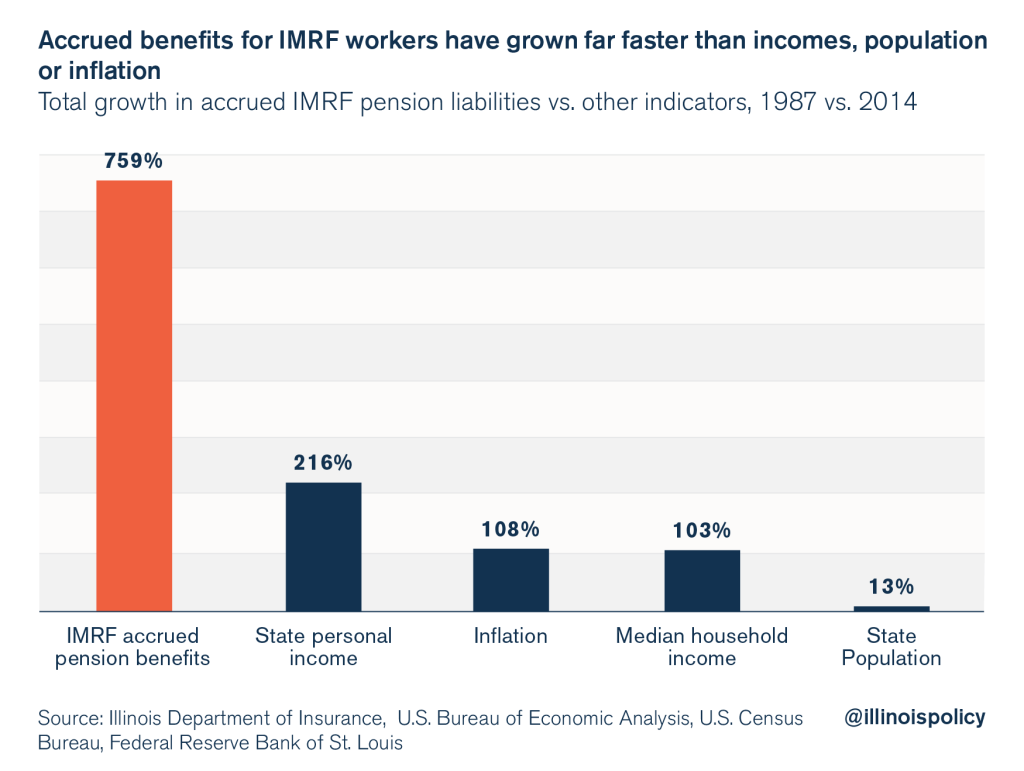

Kosiba says that IMRF pension costs are manageable, but there are hundreds of municipalities whose residents would disagree. The fund’s pension benefits have grown dramatically – nearly nine times – over the past three decades.

According to the Illinois Department of Insurance, the accrued benefits of IMRF members totaled just $5 billion in 1987. By 2014, those accrued benefits had jumped to $44 billion, a total increase of 760 percent.

In contrast, the economy has only grown 216 percent, and inflation just 108 percent over that period. The state’s population has increased just 13 percent. Median household incomes have only grown by 103 percent. IMRF pension benefits have grown far faster than any of those factors.

To understand how massive that growth in benefits is, consider that the median Illinois household income in 1987 was $27,000.

If household incomes had grown at the same rate as IMRF’s accrued pension benefits – 8.3 percent each year – households today would be earning more than $250,000 a year and not the $60,400 they take in now.

The problem of skyrocketing pension benefits is not confined to IMRF. Every pension system in Illinois has had its accrued benefits grow at such a rapid rate that appropriations cannot keep up with them in the absence of comprehensive pension reform.

- Pension benefits aren’t affordable

Kosiba also declared that pension benefits in Illinois are not “overly generous,” but the facts don’t bear that out.

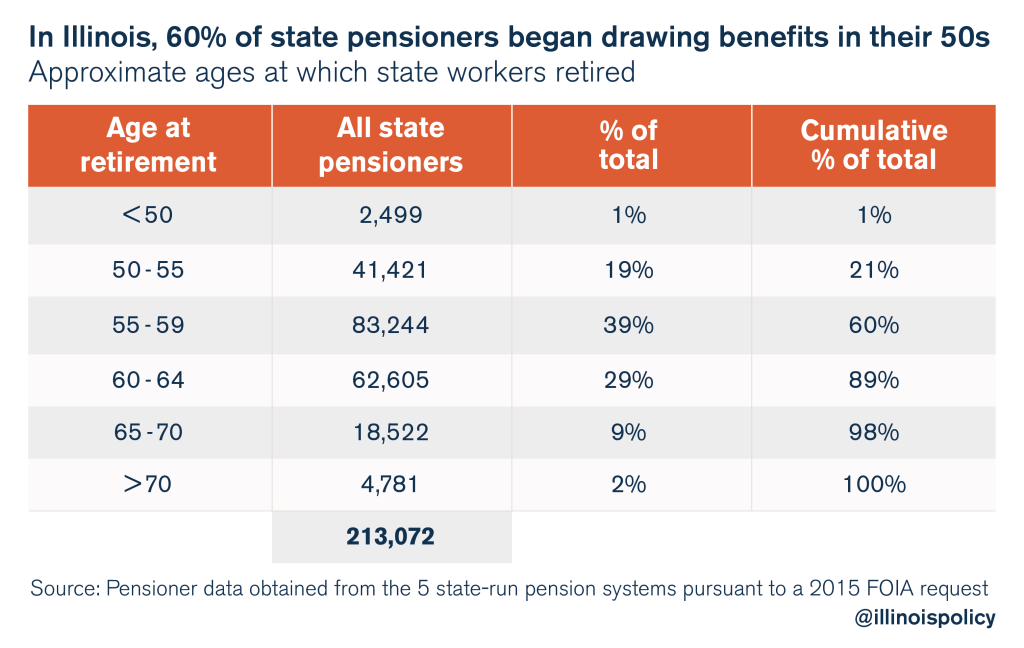

Illinois state workers at every level receive pension benefits that are too unrealistic for workers to count on and too rich for taxpayers to pay for. Here are examples of how those benefits play out: pensions rules allow workers to retire in their 50s; most receive automatic 3 percent cost-of-living adjustments in retirement; and all workers contribute little compared with what they receive in benefits.

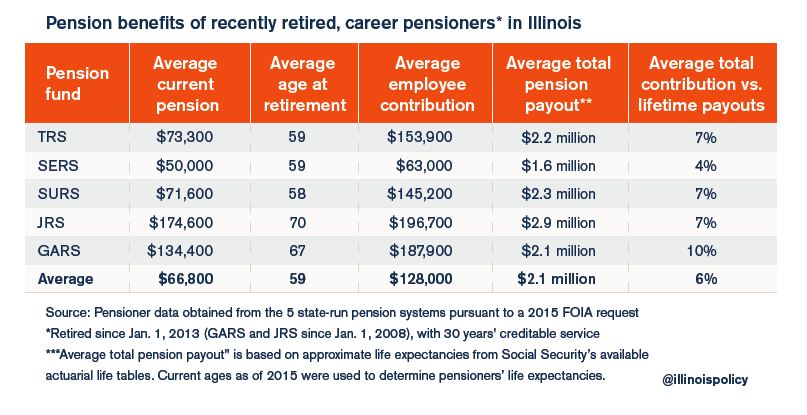

Those factors have produced the following results for state-level workers:

- 60 percent of current state pensioners retired and began drawing pensions in their 50s, many with full benefits.

- The average pensioner who worked 30 years or more receives $66,800 in annual pension benefits and will collect over $2 million in total benefits over the course of his or her retirement (30 percent of recent retirees are career workers).

- The average career pensioner will see his or her pension payments double to more than $130,000 in retirement.

- Career pensioners will get back their employee contributions after just two years in retirement. In all, pensioners’ direct employee contributions will only equal 6 percent of what they will receive in benefits.

To be clear, government workers who earn generous pension benefits have done nothing wrong. They’ve benefited from labor negotiations that have led to lucrative compensation packages. However, those benefits are simply too expensive for taxpayers to continue funding.

- Pensions are being propped up on the back of Tier 2 workers

Kosiba said pension reforms are unnecessary due to the reforms enacted in 2011. State workers hired after Jan. 1, 2011, are required to enroll in a substandard pension plan known as Tier 2.

What Kosiba failed to mention is what that reform entailed. Rather than reform worker retirements responsibly, Illinois lawmakers dramatically reduced the benefits of new workers to the point where those workers will put in more than they actually get back in benefits. New workers actually lose money when saving for retirement.

A loss for newer workers is a subsidy for the pensions of those hired before 2011. Without that subsidy, Illinois’ pension funds would be collapsing even faster.

Unfortunately, the pension system is being propped up on the backs of newer state workers. Newer employees should not be asked to sacrifice their retirements to pay for the mistakes of politicians.

Yet that’s exactly what Kosiba has pointed to as a reason there is no need for pension reform.

Kosiba is not an unbiased observer

As the executive director at one of the largest pension funds in the state, Kosiba directly benefits from the funding guarantee that ensures his pension gets paid, regardless of the financial condition of Illinois and its taxpayers.

Kosiba will have nearly 30 years of service by the time he retires in December 2017. His $250,000 salary ensures he’ll collect $3 million in pension benefits over the course of his retirement, assuming he lives to the age predicted by IMRF actuaries.

Kosiba’s article reveals the unfortunate reality of pensions: They are inherently political, opaque and void of accountability. As long as politicians maintain control over pensions, they’ll always find ways to exploit them and pass on the costs to taxpayers.

Government workers will only have true retirement security when they are no longer subject to the instability of defined-benefit pension plans.

The solution, along with a slate of other important reforms, is to provide Illinois workers with a real funding guarantee in the form of self-managed retirement plans, giving both taxpayers and governments more budget certainty and granting workers the retirement security they deserve.