Illinois lost 86,000 people on net to Wisconsin over the past decade

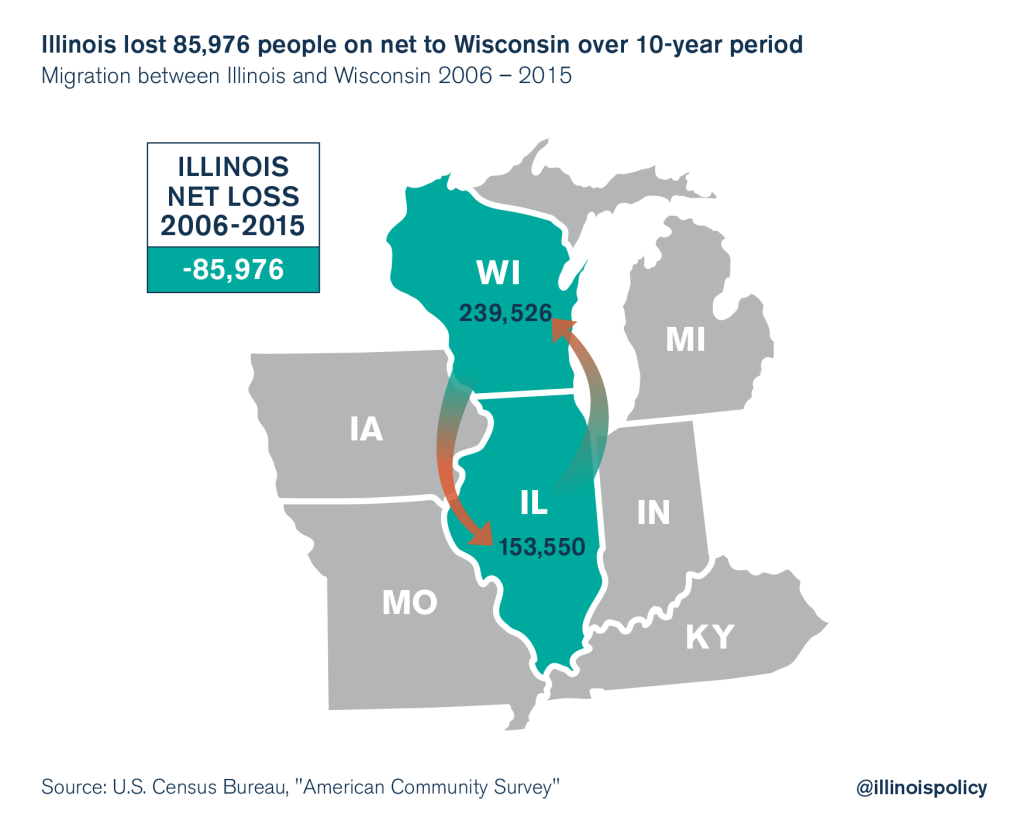

Illinois lost almost 24 residents per day to Wisconsin from 2006 through 2015.

Each year, thousands of Illinoisans move to Packers’ territory to escape the high tax burden south of the border.

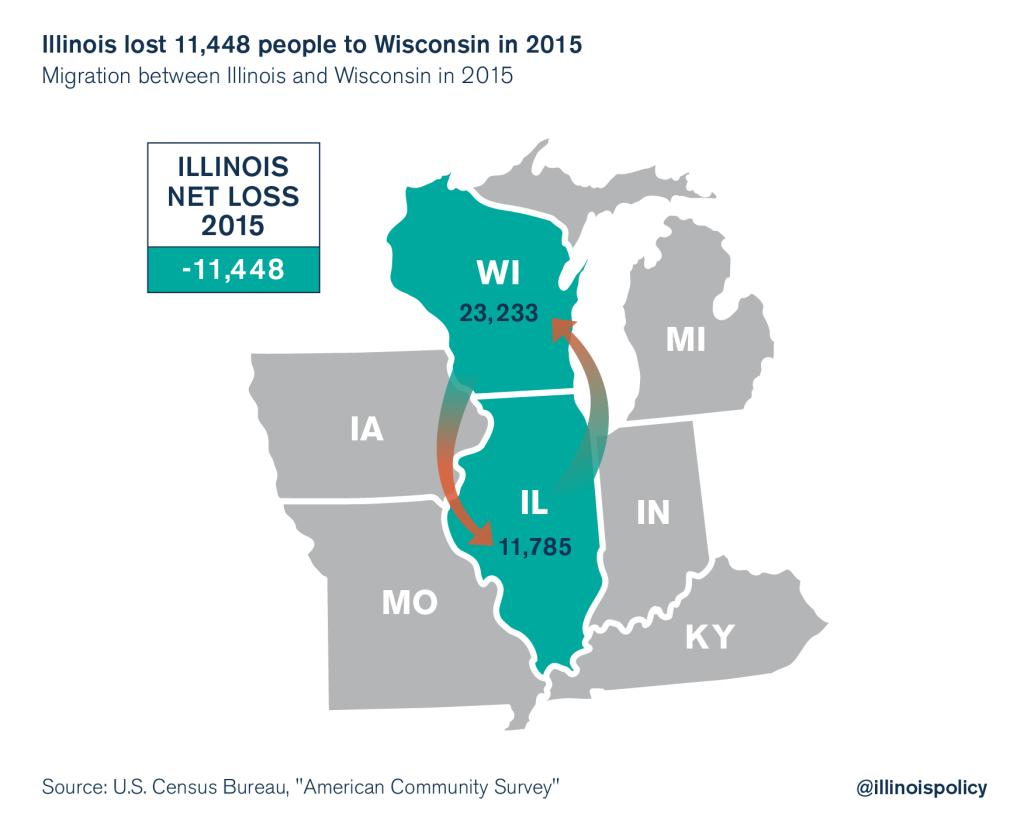

Illinois suffered a net loss of more than 11,000 people to Wisconsin in 2015, according to data from the U.S. Census Bureau. That’s the equivalent of more than 31 Illinoisans becoming Wisconsinites on a daily basis.

Illinoisans have routinely relocated to the Badger State over the past decade. During the 10-year period from 2006 through 2015, Illinois lost almost 86,000 people on net to Wisconsin. That’s an average net loss of nearly 9,000 people per year and almost 24 per day.

Illinois’ population losses aren’t the norm in the Midwest. In fact, the Land of Lincoln is the only state in the region with a shrinking population, and half of the Illinoisans who left in 2015 relocated to other Midwestern states. Fleeing Illinoisans are reacting to the hard-hitting effects of a struggling state spiraling downward toward fiscal insolvency. But as more Illinoisans check out, the state’s tax base is shrinking, making it even harder for Illinois to balance its books.

It’s easy to see why Wisconsin is an attractive alternative to Illinois.

Whereas Illinois burdens residents with some of the highest property taxes in the nation, Wisconsin’s property tax rates are currently at their lowest point since the end of World War II.

Illinois’ out-of-step property taxes also hurt businesses, some of which ultimately decide to move their operations a few miles north of Illinois’ border into more manufacturing-friendly Wisconsin.

The buck doesn’t stop there. Wisconsin’s 4 percent unemployment rate is significantly lower than Illinois’, which creeped back up to 5.7 percent in December. Wisconsin also has Right-to-Work legislation on the books – which gives workers the right to choose whether or not to participate in unions, and has been shown to spur both jobs and income growth.

What’s more, Wisconsin reported an unexpected $21 million surplus for the state’s upcoming budget, much of which came from hundreds of millions of dollars’ worth of higher-than-anticipated tax revenues. Wisconsin Gov. Scott Walker cut taxes by more than $4.7 billion during his tenure, so the increased tax revenue isn’t the result of tax hikes.

Compared with Illinois, Wisconsin is friendlier to taxpayers and businesses, and the state’s surplus has paved the way for responsible state spending. Wisconsin’s close proximity also makes the move from Illinois practical.

By contrast, Illinois’ rampant government spending and anti-growth policies have buried the state in a $7.1 billion budget hole, while pension debt and unpaid bills total more than $140 billion.

State senators are proposing multimillion-dollar tax hikes to stem Illinois’ financial woes. But this would hurt businesses and taxpayers and wouldn’t solve Illinois’ budget problems, which stem from uncontrolled state spending. After raising more than $31 billion following the 2011 income tax hikes, for example, Illinois still grew the budget instead of paying down debts.

Furthermore, the most prudent way to increase tax revenue is to grow the state’s tax base: More people paying into government coffers is far better than fewer people paying more. The following pro-growth reforms would be a good start to making Illinois a state worthy of investment rather than divestment:

- Property tax freeze with structural reforms, to give taxpayers much-needed relief and protect home values

- Enactment of Right to Work, so that Illinois can compete with surrounding states

- Fixing cost drivers, such as pensions, workers’ compensation and collective bargaining

Illinois is at risk of nosediving into a financial and economic death spiral. As demonstrated by Wisconsin’s reforms and resulting surplus, Illinois needs to make serious structural reforms to attract people and investment all the while curbing irresponsible state spending.