Illinois politicians’ remedy for state flirting with recession? Multibillion-dollar tax hikes

A new report from the Commission on Government Forecasting and Accountability shows Illinois has experienced falling tax collections, which may indicate trouble in the state economy; spending reforms – not tax hikes – are what Illinois needs to right its fiscal ship and boost economic growth.

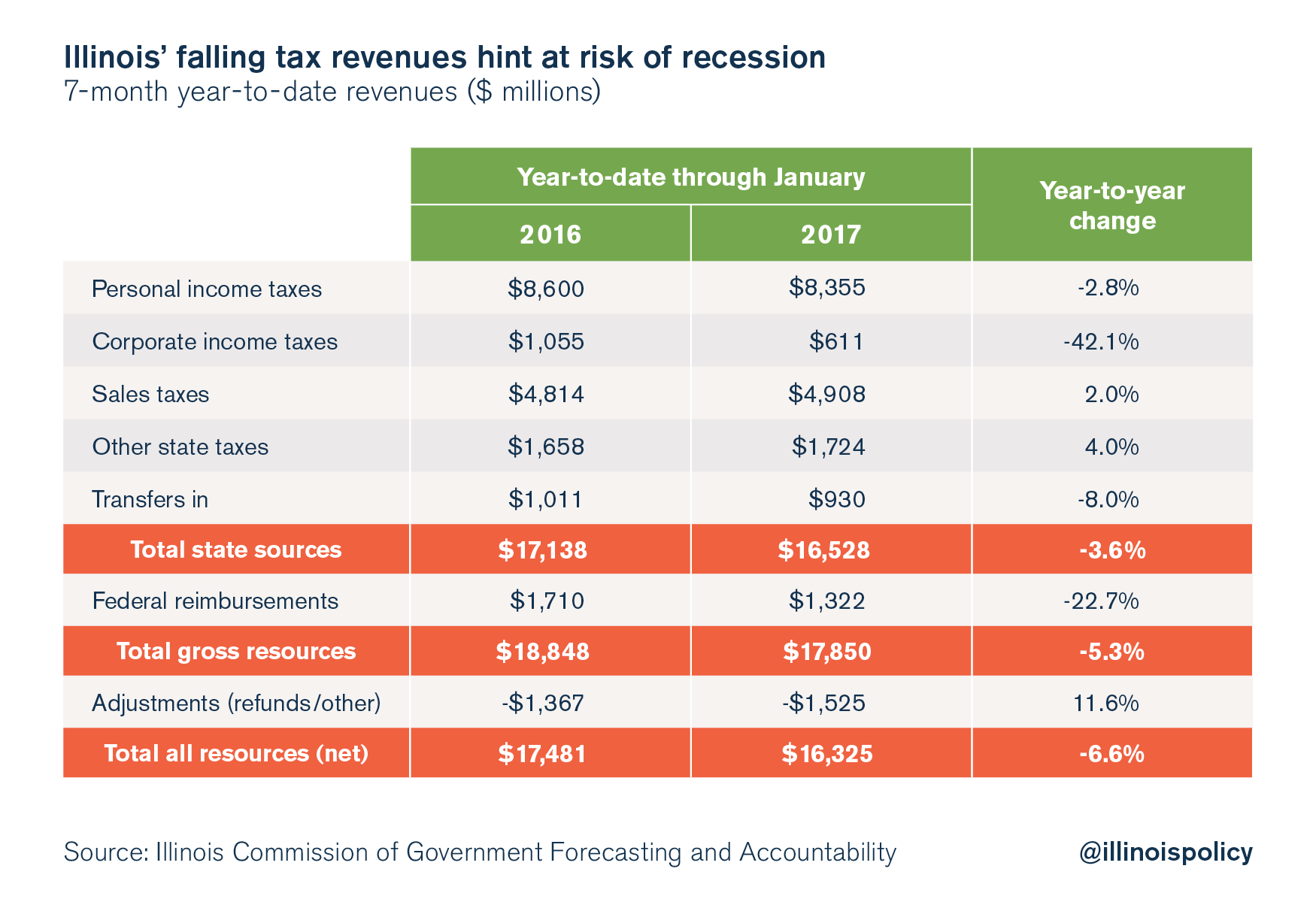

Illinois state government has collected $1 billion, or 6.6 percent, less from July 2016 through January 2017 than it did during the same time frame in 2015 and 2016, according to the Commission on Government Forecasting and Accountability, or COGFA. These numbers could indicate Illinois is entering another recession.

COGFA issued its latest report Feb. 2 on how much money the state is collecting in sales and income taxes, and it spells trouble for Illinois’ economy. The state income and sales tax rates remained the same from 2016 to 2017, signaling that the reduction in revenues is driven by some combination of less business activity, a weak job market, stagnant incomes and fewer taxpayers.

The Illinois Senate’s current push for a multibillion-dollar tax hike – its “grand bargain” – won’t do anything to help. In fact, it will just make things worse.

Slightly higher sales tax collections weren’t enough to cover a nearly $500 million, or 42 percent, drop in corporate income tax revenues and a more than $200 million decline in personal income tax collections.

To make things worse, federal funds from Washington, D.C., also fell $400 million, or almost 23 percent.

The fact that state government collected less money from July 2016 through January 2017 than it collected from July 2015 through January 2016 could mean the state is on the brink of recession.

According to COGFA’s 2017 briefing, “As in prior months, continued weaker income taxes along with poor federal sources more than offset gains experienced by the other revenue sources, adding further concern to observations made in last month’s briefing.”

COGFA’s previous observations in its 2016 briefing noted that Illinois’ major sources of revenue were “experiencing levels of weakness not seen since the last recession.”

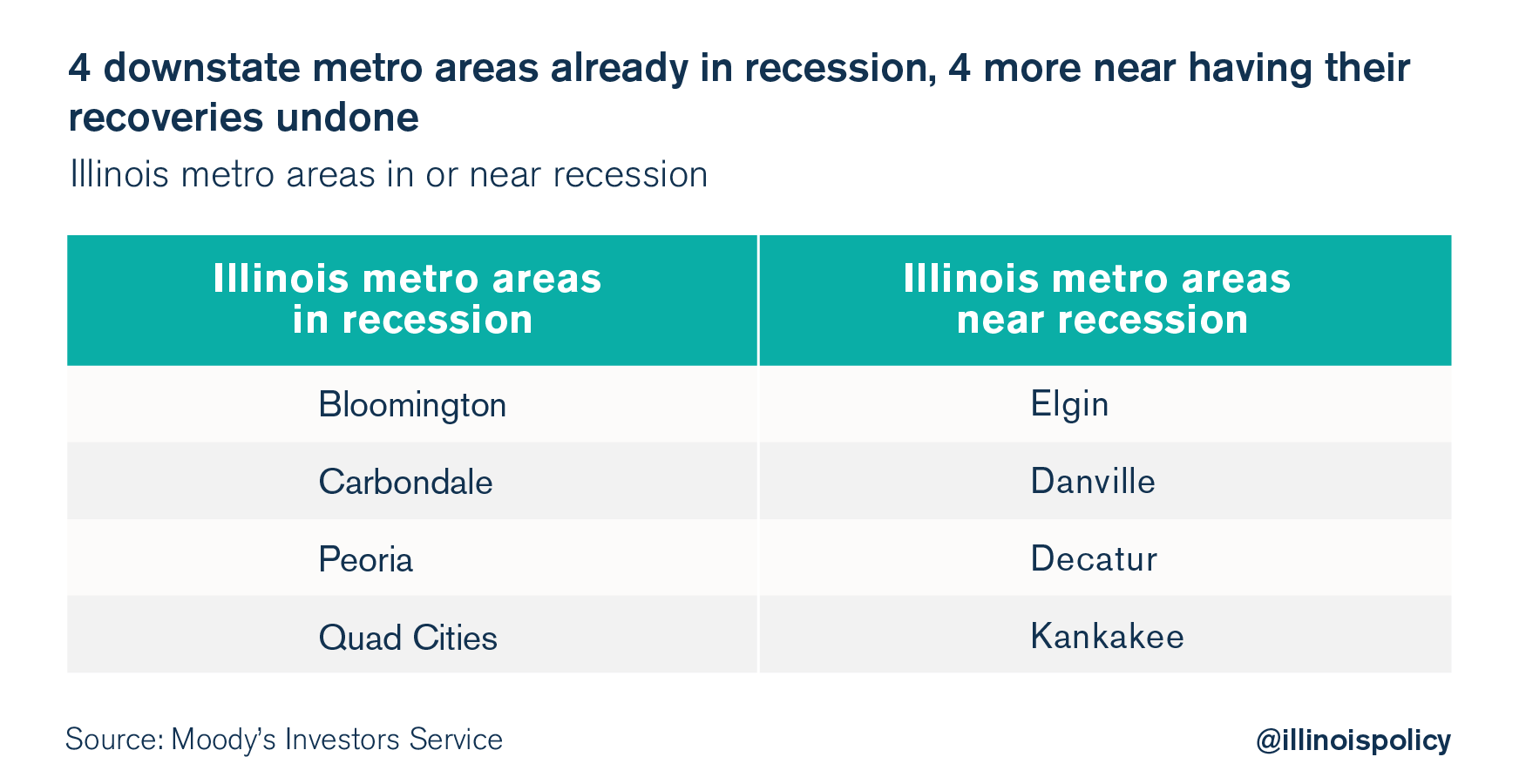

COGFA’s worries are backed up by a recent Moody’s Analytics report that warned, “Illinois is one of the Midwest’s weakest links, reflecting both soft job creation and the state’s descent into fiscal quicksand.”

According to the study, Illinois “is home to four of the Midwest’s eight metro areas in recession.” Those areas are Bloomington, Carbondale, Peoria and the Quad Cities. The report further notes that economic recoveries in other communtites, including Elgin, Danville, Decatur and Kankakee, are “at risk of coming undone.”

These struggling communities – and the state’s economy as a whole – aren’t helped by the fact that Illinois is losing part of its tax base to other states.

Illinois has lost, on net, more than 1.2 million residents between 2000 and 2015, and those former residents have taken more than $40 billion in taxable income with them. Illinois’ total population has shrunk for three years in a row.

According to a recent poll by the Paul Simon Public Policy Institute, this trend may continue. Of the Illinois registered voters polled, 47 percent said they want to leave Illinois. Respondents cited taxes as the single biggest reason they wanted to leave.

This makes the current state budget deal being negotiated in Springfield – a multibillion-dollar tax hike – absurd.

As the state’s economy sputters and Illinoisans flee, the last thing politicians should be talking about is a tax hike. But that’s exactly what the Illinois Senate’s “grand bargain” does.

A tax increase won’t help to boost the economy or stop Illinoisans from moving.

Instead of debating how much to tax and the different ways to do it, the General Assembly should focus on policies that reform how it spends money.

The Illinois Policy Institute has laid out those reforms in Budget Solutions 2018. This plan balances the budget without tax hikes through changes in five policy areas:

- Comprehensive property tax reform

- Ending Illinois’ pension crisis through self-managed plans

- Aligning AFSCME costs with what taxpayers can afford

- Streamlining Medicaid spending

- Higher education reform that prioritizes students over administrators

Illinois needs policies that keep its people here and draw residents and businesses in from other states. Tax hikes are not that solution.