Illinois should make public university tuition more affordable – not subsidize inflated costs with tax dollars

House Bill 1316 would force taxpayers to help fill the gap between high tuition costs and student affordability. The bill would increase government spending, but undermine Illinois’ public colleges and universities' incentive to lower tuition costs to compete for students.

Illinois lost approximately 195,000 recent high-school graduates to out-of-state colleges, on net, from 2000 through 2014, according to official state-to-state student migration data from the National Center for Education Statistics. The share of Illinois college students remaining in-state for college was down 9 percentage points in 2014 compared with 2000.

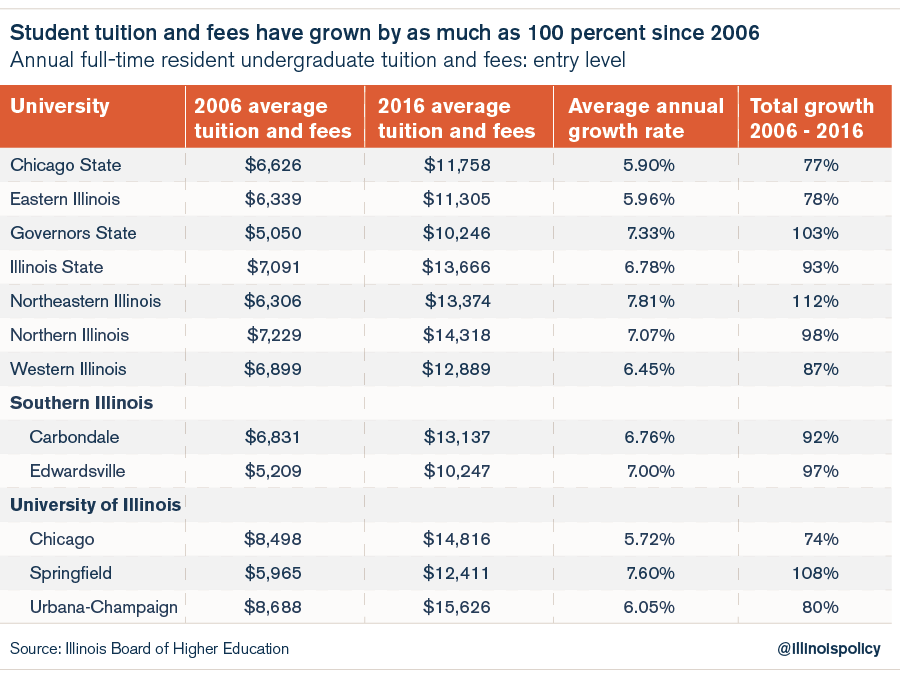

Meanwhile, tuition at Illinois’ public colleges and universities grew as much as 100 percent from 2006 through 2016. For years, pensions have eaten up bigger chunks of state spending on higher education and forced students to make up the difference in operational funding. Illinois’ higher-education bureaucracy has also been swelling for decades, which means more state spending is allocated to funding a growing lot of administrators’ exorbitant salaries instead of operational costs.

At the University of Illinois at Urbana-Champaign, for instance, average tuition and fees cost $15,626 annually in 2016, up 80 percent since 2006.

Given these alarming trends, Illinois’ chronic net loss of young college students and skyrocketing tuition are clearly deserving of legislators’ attention.

The right problem and the wrong solution

State Rep. Lou Lang, D-Skokie, is the chief sponsor of House Bill 1316, which would create “College Affordability” grants for Illinois college students with at least B-averages and family incomes of $125,000 or less. Grants would not exceed $4,000 annually, and eligible students would have to attend an in-state public college or university full-time in the fall term following high-school graduation.

The bill would also allow the state to purchase private student-loan debt at a 0 percent interest rate for eligible participants who graduated before the 2018-2019 academic year, and who are currently repaying federal student loans.

The bill’s sponsors claim HB 1316 would help reverse the state’s student out-migration problem. But HB 1316 would merely drive up government spending without fixing the underlying issues causing tuition to skyrocket and sending young college students packing in the first place.

Lawmakers have not put forth a plan to address cost drivers in the state’s public higher-education system. Alternatively, HB 1316 proposes footing taxpayers with a larger share of the tuition bill for some students, but costs would likely still rise across the board.

Under this legislation, public universities and colleges would reap the rewards of additional guaranteed tax revenue funneled through student grants, which means those institutions would have little need to bring tuition costs in line with what students could realistically afford. Instead, HB 1316 would guarantee taxpayers would help bridge that gap.

The bill would merely shift the heavy tuition burden from the backs of students to the backs of taxpayers, as opposed to taking steps to actually bring down tuition costs.

Even if students like the sound of this bill, it’s unclear where Illinois would find the revenue to fund these grants, or how the state would manage to purchase and pay off student-loan debt – especially considering the state can’t even manage its current debt load. Illinois politicians already spend more than the state takes in, and adding more spending items will only bury the state even deeper in debt.

Furthermore, HB 1316 contains a two-year Illinois residency requirement effective once participating students graduate. While it makes sense that legislators would want to prevent students from benefiting from these grants and then taking their skills to other states, bribing recent college graduates to stay in Illinois despite a weak job market isn’t exactly in those graduates’ best interest.

Real solutions

Illinois’ student exodus is symptomatic of structural mismanagement at the public higher-education and state levels, which has culminated in skyrocketing tuition costs and poor economic growth that scare young people away from Illinois.

Rather than keep tuition low, Illinois colleges and universities have taken the flood of federal and state monies available to higher education over the past two decades and spent it on a massive increase in administrative positions and exorbitant executive compensation. As of 2015, Illinois spent more money on higher-education retirement costs than on university operations, whereas retirement costs consumed only 20 percent of the state’s total higher-education spending in 2006. This reprioritization of spending makes it easy to understand why higher-education institutions are demanding more tuition dollars to fill gaps in classroom funding.

Illinois policymakers shouldn’t squeeze taxpayers for more tax dollars to subsidize these inflated tuition costs.

If students are leaving Illinois because tuition is too expensive, state colleges and universities should examine their spending habits and modify their tuition rates. That’s how it works in the private sector: You must have a better value proposition than your competitors, or you will lose customers – or in this case, students.

Public colleges and universities should reprioritize students by checking growing pension and administrative costs against classroom needs to better leverage tuition costs with student affordability. At the same time, policymakers must pursue pro-growth reforms aimed at growing jobs and personal income. This will better ensure college graduates want and can afford to stay in Illinois, eliminating the need for a residency requirement.

Illinois policymakers must learn to manage existing state programs before creating new ones that promise tax dollars the state doesn’t have.