Rauner vetoes state bailout of CPS pensions

Gov. Bruce Rauner vetoed the $215 million bailout of Chicago Public Schools’ ailing teachers’ pension fund.

Gov. Bruce Rauner vetoed Dec. 1 what would have been yet another taxpayer bailout for Chicago Public Schools, or CPS. CPS and Chicago Mayor Rahm Emanuel were counting on $215 million from the state to help keep the district’s collapsing pension plan afloat. In exchange, Rauner was expecting a deal on statewide pension reform from Illinois Senate President John Cullerton before the year’s end.

But the deal fell apart. Rauner claimed Cullerton didn’t do his part to get a state pension bill passed. Cullerton denied such a deal even existed, according to the Chicago Sun-Times. Emanuel criticized the veto as “reckless and irresponsible,” ignoring his own repeated failures to hold the line on costs at CPS.

Finger pointing aside, the veto was the right thing to do. A state bailout of CPS is wrong. Here are three reasons why:

- Illinois can’t afford to bail out anybody.

An Illinois bailout of CPS is like Puerto Rico bailing out Greece. It just won’t work.

That’s particularly true when it comes to pensions. As bad as CPS pensions are, the state’s funds are in even worse shape.

The Teachers’ Retirement System, the pension plan for all teachers in Illinois outside of Chicago, has just 38 percent of the funds it needs today to meet its future obligations. In contrast, CPS’ pension plan is 52 percent funded.

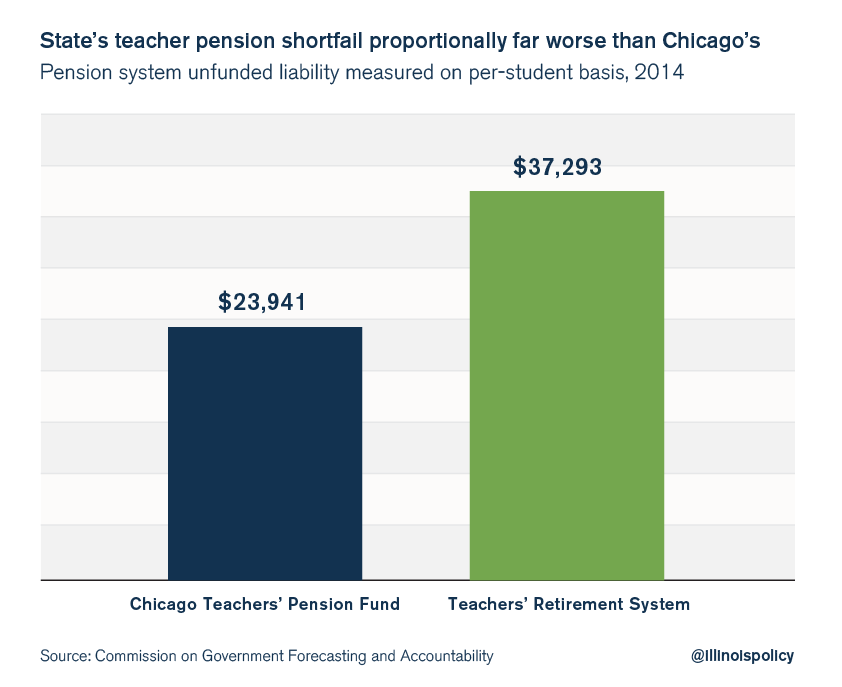

That means state taxpayers are already on the hook for a fund that’s in worse shape than the one Chicago taxpayers have to bail out.

When the pension shortfalls are measured on a per-student basis, the downstate fund is significantly worse off than the Chicago pension fund. The downstate fund has a $37,000 pension shortfall for each student, while Chicago’s gap is $24,000 per student.

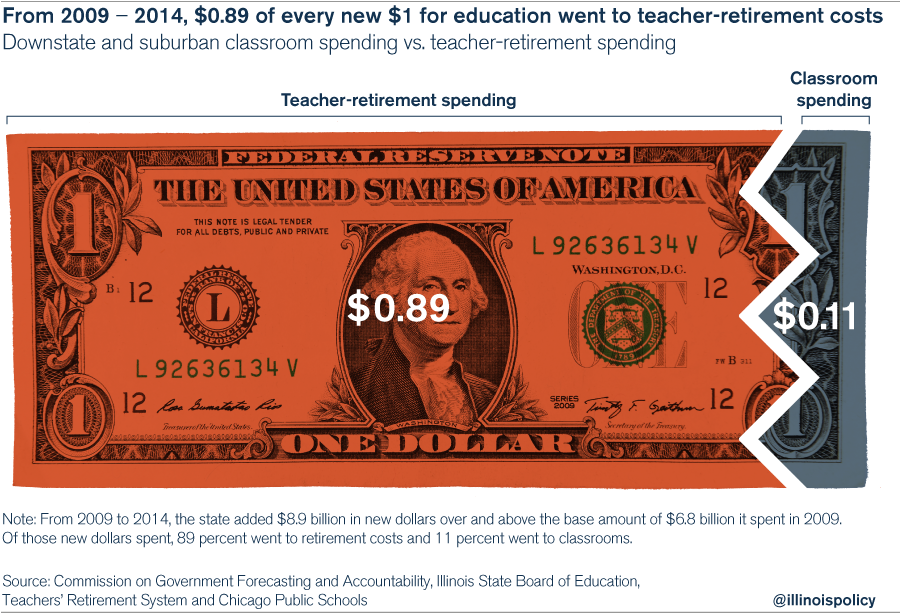

Pension costs have been swallowing up nearly every single dollar that’s gone into downstate education in recent years.

From 2009 to 2014, 89 cents of every new dollar for downstate education went to teacher retirement costs. Even with those contributions, the solvency of the downstate pension system continued to worsen.

CPS dug its own hole, and it’s unreasonable to expect state taxpayers, who are on the hook for the even less healthy downstate system, to rescue it. CPS failed to fund pensions for most of the past 15 years. Instead, it chose to channel its taxpayer funds toward salaries and other benefits, including teacher pension pickups. Now it’s time for CPS to pay the bill, and the district wants state taxpayers to pay it.

- The state shouldn’t pay for the yearly pension costs of teachers for any school district.

CPS officials want the state to pay for the district’s yearly pension costs, as the state already does for every other school district in Illinois.

But that’s the exact wrong thing to do. Instead, the state should stop paying for the pension costs of all districts.

The current arrangement gives school districts incentives to be irresponsible. Districts dole out higher pay, end-of-career salary hikes and pensionable perks (such as accumulated sick leave that employees can convert into pension benefits), knowing the state will pay the cost of the resulting higher pensions.

Rauner is right to not pay the pension costs of CPS. As a next step, Rauner and the state must stop subsidizing the yearly pension costs of Illinois’ other 856 school districts. Only then might school districts begin to rein in the pay and benefits they hand out.

- Emanuel helped make the CPS pension mess.

The mayor’s had several chances to reform costs at CPS. Instead, he’s caved repeatedly to the Chicago Teachers Union’s, or CTU’s, demands.

In October 2012, when the district was already facing a $1 billion budget deficit and an $8 billion teacher pension shortfall, Emanuel’s agreement with the then-striking union cost CPS hundreds of millions of dollars, if not billions, in higher operating and retirement costs.

Those higher costs eventually led to thousands of teacher pink slips, 50 school closures, the need for safe passage routes through gang areas, and the district’s spiral toward insolvency.

In October 2016, Rahm gave in to CTU again, to the detriment of Chicago taxpayers.

Under the terms of the new four-year contract, teachers will receive raises of 2 and 2.5 percent in 2018 and 2019 on top of “step and lane” salary bumps, the automatic salary increases for length of tenure and the educational attainment of teachers, which occur without regard to their effect on educational outcomes.

In addition, CPS agreed to continue “picking up” the employee pension contributions for current CPS teachers – a benefit that costs the school district, meaning taxpayers, more than $130 million every year. Since 1981, CPS has paid 7 of the required 9 percent annual employee contribution as a perk for teachers; teachers only contribute 2 percent of their annual salaries toward their own pensions.

Under the contract, newly hired teachers won’t receive the pickup benefit. However, CPS agreed to grant new teachers additional 3.5 percent raises instead. CPS made this concession despite the fact that Chicago teachers are already the highest-paid among the nation’s 10 largest school districts.

Emanuel may want to blame others for CPS’ financial woes. But through his own deals he’s dug the district’s hole even deeper.