Chicago anticipated to be nation’s weakest major housing market in 2019

A study by realtor.com ranks the Chicago region’s housing market slowest of 100 U.S. metro areas for 2019. That stat could be fixed, or made worse.

A report released Nov. 27 by realtor.com forecasts the Chicago-Naperville-Elgin Metropolitan Area will experience the worst housing market slowdown among 100 of the nation’s metropolitan areas in 2019.

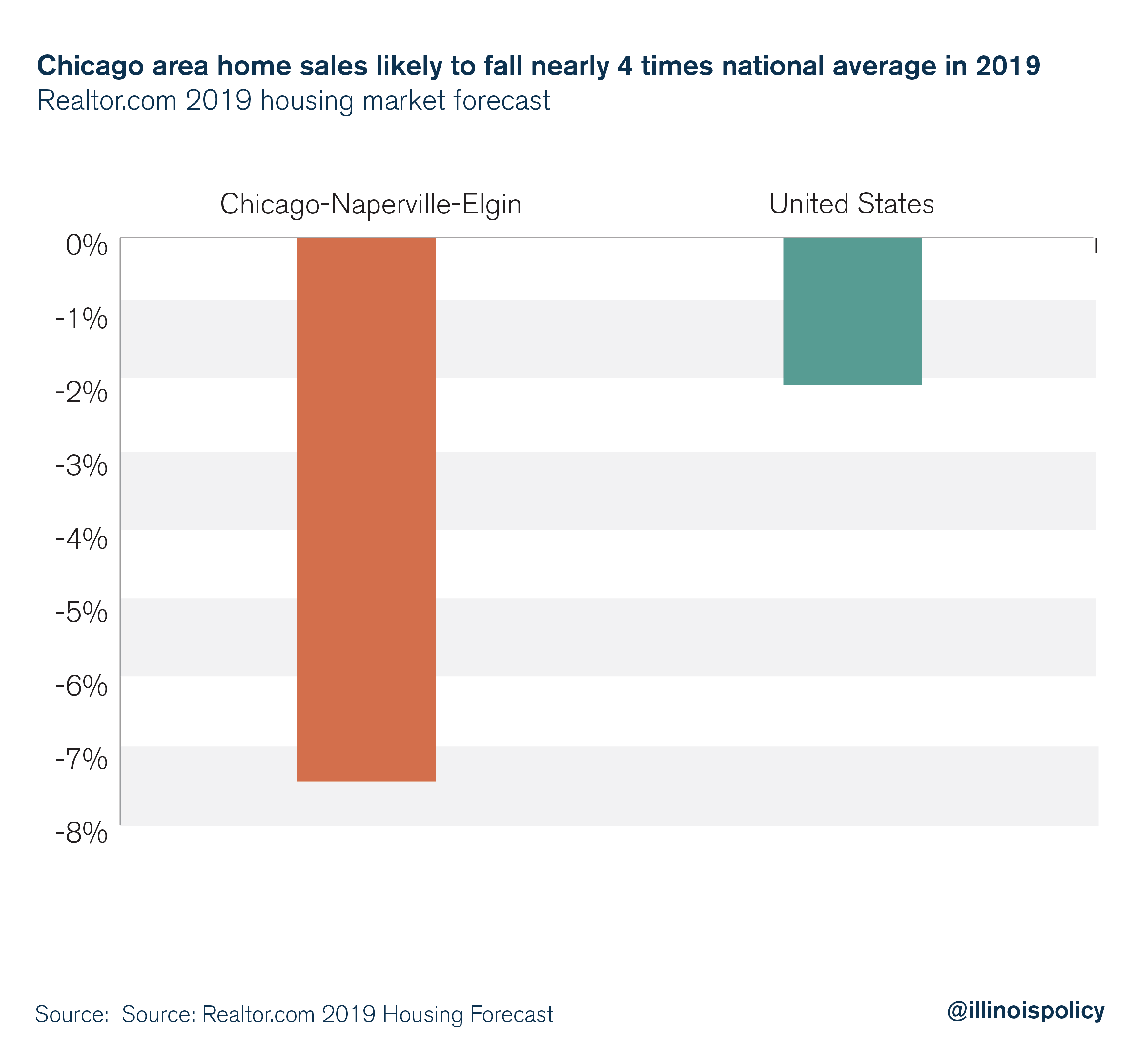

As mortgage rates are slowly creeping up to 5.5 percent, home sales are expected to slow nationwide. However, the slowdown is anticipated to be nearly four times worse in Chicago than in the rest of the nation.

Illinois homeowners are subject to the highest overall tax burden in the country, including the second highest property taxes in the nation. They’re also weathering the largest permanent income tax hike in state history. As these costs rise, the value of homeownership in the Land of Lincoln falls relative to other areas, reducing demand for housing.

Furthermore, as median home prices are expected to appreciate by 2.2 percent throughout the nation, the typical Chicago area home will likely lose nearly 2 percent of its total value in 2019, according to the realtor.com forecast.

The combination of steeply declining home sales and values lands the Chicagoland housing market at the bottom for 2019.

Why is housing demand declining faster in Chicago?

Chicago’s disturbing housing market performance comes as no surprise. Illinois is one of only three states where single family homes became a worse investment relative to before the housing bubble.

The poor health of the state’s – and Chicago’s – real estate market is due to a variety of factors.

Outmigration

For starters, the Illinois population has been declining for four consecutive years, second only to West Virginia. The Chicago metro area was the only one of the 10 largest metro areas to experience population decline last year. While births still outpace deaths in Illinois and Chicago, the population has been declining due to persistent outmigration.

The shrinking population isn’t due to snowbirds retiring to warm-weather states such as Florida. The primary driver of the state’s population decline is from prime working-age Illinoisans (25-54 years old) moving away. Not only is Illinois hemorrhaging its current workforce, hindering the growth in home prices and sales, but population losses are also compromising its future workforce as these working-age adults move away with their children. As the decline in Illinois’ youngest population cohorts – those most likely to be buying homes – are more severe than in the rest of the nation, the weak Illinois housing market can be expected to continue.

Property taxes

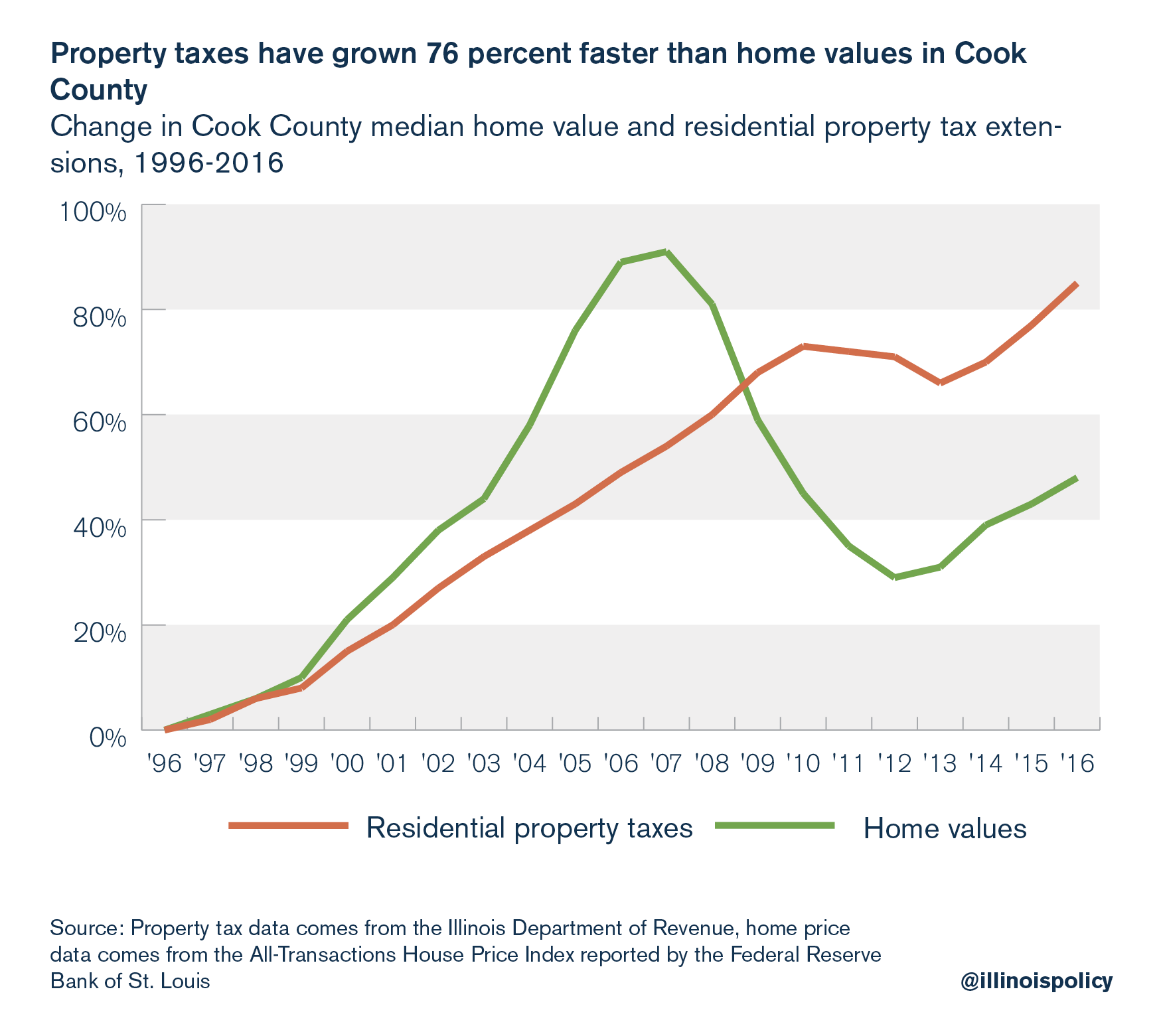

For decades, Illinois property taxes have skyrocketed compared to home values, growing 43 percent faster than home values statewide and 76 percent faster than home values in Cook County.

The dramatic rise in property taxes has resulted in Illinoisans now paying the second-highest rates in the nation.

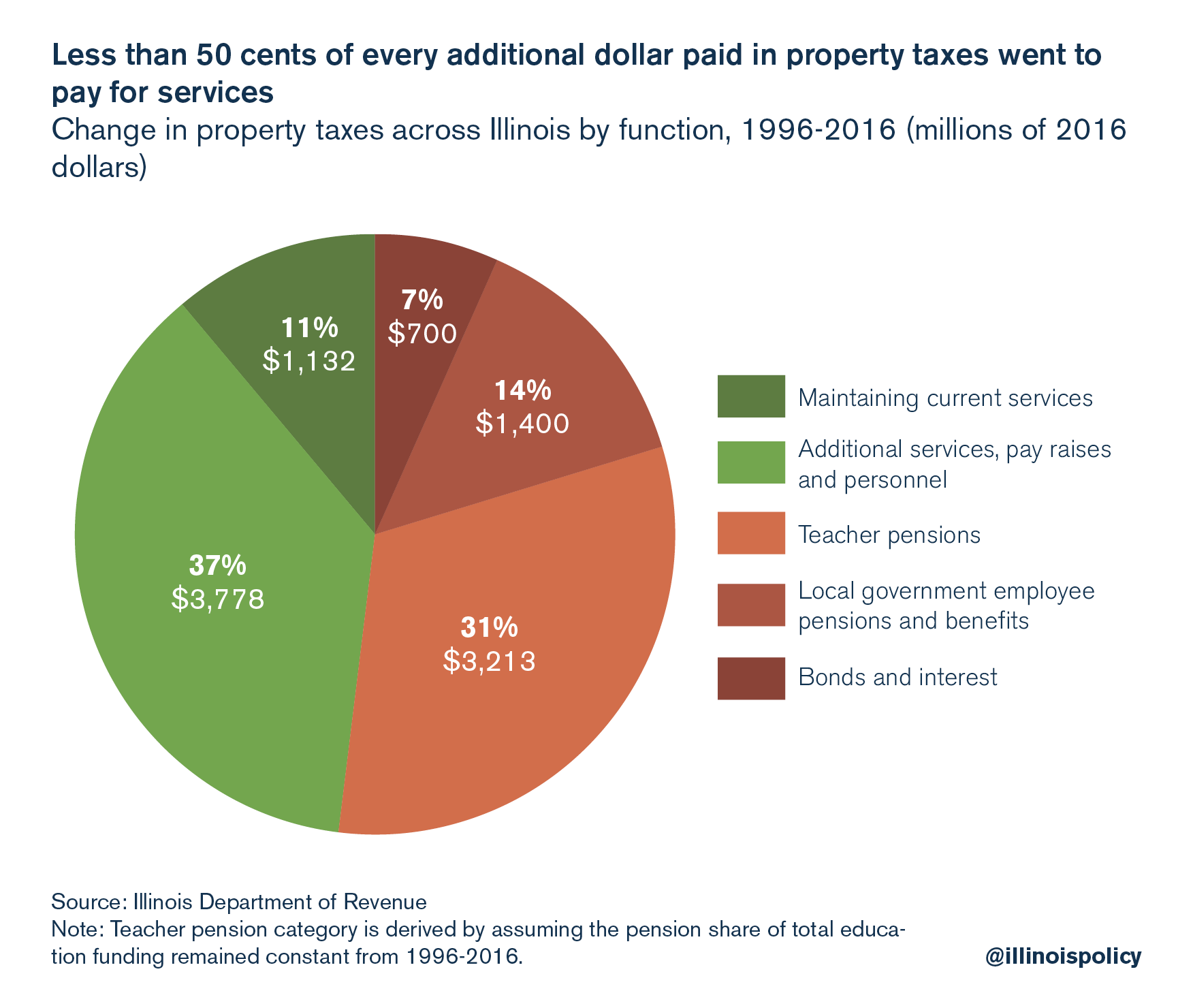

In some cases residents accept increased property taxes where they anticipate the funds will finance local services that will improve the quality of their neighborhoods and result in home price appreciation. However, this has not been the case in Illinois: For the past 20 years, fewer than 50 cents of every additional dollar paid in property taxes has gone to delivery of current services.

When additional government spending is wasted, and does not go toward the delivery of current services or improved services — all else being equal — higher property taxes do not increase the desirability of a neighborhood. This lack of improvement for additional tax dollars can cause housing prices to fall.

Income taxes

In 2017, Illinoisans were hit with the largest permanent income tax hike in state history, raising the income tax to 4.95 percent from 3.75 percent. While this 32 percent increase in the state’s individual income tax burden would be damaging enough on its own, the fact that neighboring states have been reducing income taxes since the end of the recession makes Illinois an even less inviting place to buy a house.

The most recent tax hike, just like the 2011 tax hike, can be expected to have severely negative consequences for investment within the state, resulting in fewer jobs and a smaller economy. In fact, some of these effects are already being felt as Illinois’ private-sector job creation ranks among the worst in the nation in the year since the income tax hike.

Employment growth and housing price growth are strongly correlated. Recent economic research highlights links between regional labor and housing markets. In their article, “The Recent Evolution of Local U.S. Labor Markets,” authors Maximiliano Dvorkin and Hannah Shell examined the recession and recovery by reviewing the correlation between county-level unemployment rates and changes in housing prices. U.S. counties with larger decreases in housing prices experienced larger increases in the unemployment rate.

This means declining home price appreciation could have negative spillover effects on the rest of Illinois’ economy. Illinois’ weaker housing market recovery is consistent with the state’s much weaker employment growth and weaker economic growth when compared to the rest of the country.

2019 could be worse than projected

While recent public policy has certainly hindered the health of the state’s housing market, the situation could be worse than projected in 2019.

Gov.-elect J.B. Pritzker made passage of a progressive income tax a key pillar of his campaign. While promoted as a tax break for the middle-class, the states Pritzker suggested as models for this tax change would all impose higher income taxes on the typical Illinois family. Moreover, the most recent progressive tax proposal filed in the Illinois General Assembly would have raised taxes on those earning more than $17,300.

Even if Pritzker’s progressive tax proposal were not about generating new revenue to fund campaign promises of higher spending, a progressive income tax would be worse for the state’s economy than Illinois’ constitutionally protected flat income tax.

Changing the forecast

If Pritzker wants to improve the forecast for Chicagoland – and Illinois as a whole – the state needs lasting, meaningful reforms to government cost drivers.

First, Illinois homeowners need real, sustained property tax relief. Currently, homeowners face the second-highest property tax burden in the nation, largely because of an unsustainable public pension system that is at least $130 billion in debt.

If Illinois and its local governments were able to reform their unaffordable pension systems, the state could contribute more money toward classroom spending and reduce its overall spending. Communities could provide property tax relief to make their housing more attractive.

Second, Illinoisans need a state government that spends within its means and doesn’t raise income taxes while other states cut theirs.

The Illinois Policy Institute proposed a path to balancing the budget that requires no tax increases. One key policy solution the Institute offered for fiscal year 2019 is a spending cap, which would limit the growth in government spending to the 10-year average growth rate of the state economy. Tying government spending to economic growth protects taxpayers from future tax hikes. Democratic and Republican lawmakers proposed spending caps as constitutional amendments in the Illinois Senate and House of Representatives this year.

Without property and income tax relief, housing in Illinois will continue to be less attractive, Illinois’ population will likely continue its decline, and the Chicago-area housing market will continue to be among the worst in the nation.