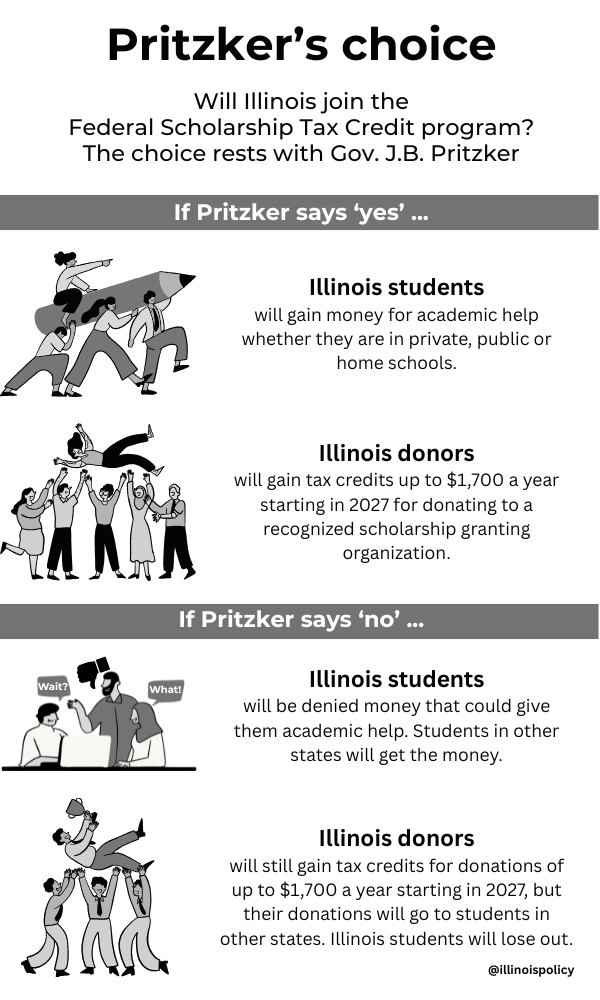

Donors can help Illinois students, but will Pritzker let them?

A new federal program would provide donor funds to school children in Illinois. But the governor must allow it.

Students could soon benefit from scholarship funds to help them find a tutor, attend a different school, get special lessons or help with curriculum.

But that will only happen in Illinois if Gov. J.B. Pritzker lets the state’s schoolchildren benefit from the Federal Scholarship Tax Credit program, established by the Educational Choice for Children Act. If he doesn’t, money from Illinois donors will go to children in other states.

Here’s what the program could mean for Illinois students and families.

1) The scholarships benefit public and private school students

Starting in 2027, the scholarship funds can be used by students in public or private schools for educational services such as tutoring, additional educational classes, books or online educational materials, fees for standardized or college admission exams and fees for dual enrollment.

This means public school students who may be struggling in certain academic areas or needing extra help or materials won’t have to leave their local public schools to find the support or opportunities they need. Or, their families will gain the option to send them to a private school if that better fits their needs.

The most recent state test scores for Illinois show half of students in third through eighth grade read at grade level in spring 2025. In math, just 39% were proficient. For 11th graders, only 52% were reading at grade level in spring 2025 and 39% performed math proficiently.

Illinois students are struggling. The scholarship program offers families a way to provide the academic support their children need, either at home, at their local public school or at a private school.

2) Scholarships take no money from public schools

The program does not take money away from public schools. It will not divert federal money or state money from public schools to fund the scholarships.

Instead, the scholarships are donated by taxpayers who will be granted federal tax credits for giving up to $1,700 each year. That’s a limited credit that will matter little to a billionaire but that can benefit middle-income givers. Any taxpayer can receive a dollar-for-dollar federal tax credit for making a qualified contribution to a scholarship granting organization, which is a tax-exempt organization providing scholarships to students.

That means the only cost to the federal government is minimal foregone income tax revenue. There is no cost to states, only the benefit of more help flowing directly to students.

3) Illinois taxpayers can get the tax credit no matter what, so rejecting the program will only deprive kids of available funding

If Illinois fails to opt into the federal scholarship program, its residents can still obtain the tax credit by donating to a scholarship organization. But that money would go to another state.

No Illinois students would be eligible for the funds.

It’s not a good look for teachers unions or other opponents of the federal scholarships, who falsely claim the program takes money from public education. The program promises to add money from donors to public, private and home schools.

Opponents are against Illinois children receiving donor funds for tutoring and other academic services. If they succeed, other states’ children will benefit and Illinois children will be left behind.

4) The scholarships provide additional resources to students with disabilities

The funds can also be used for educational therapies for students with disabilities enrolled in the public school system or in a private or home school.

Most students with disabilities enroll in public schools. In the 2024-2025 school year, there were nearly 375,000 students with disabilities enrolled in public schools in Illinois.

Nationally, 95% of school-aged students with disabilities were enrolled in regular public schools in fall 2022, according to the National Center for Education Statistics. Only 2% were placed in regular private schools by their parents.

Because most families of students with disabilities enroll their children in public schools, families could gain access to funds for additional educational therapies to help their child thrive in their public school.

5) School choice is popular among families and voters in Illinois

Illinoisans strongly support school choice programs. Illinois voters were 3-to-1 in support of the state’s Invest in Kids tax-credit scholarship program for low-income students before lawmakers bowed to teachers union pressure and refused to renew the program.

A national poll found 74% of Americans support school choice, and 65% support the Federal Scholarship Tax Credit program.

6) Federal scholarships return hope to Illinois students stripped of Invest in Kids scholarships

Illinois bucked national trends in November 2023 when lawmakers made Illinois the only state to roll back a school choice program. More than 15,000 students were stripped of their state tax-credit scholarships at the end of the 2023-2024 school year, despite the success of the program and a long waiting list.

Students with the largest year-over-year learning gains were Invest in Kids scholarship recipients, an Illinois State Board of Education report showed in 2024. Scholarship recipients, most of whom were from households earning less than $49,025, were more proficient in reading and math compared to their low-income peers in Illinois public schools. That was despite slight differences in the definition of “low-income” impeding a precise apples-to-apples comparison by the state.

Still, lawmakers killed the Invest in Kids program in November 2023 after teachers unions funneled nearly $1.5 million to lawmakers ahead of session. They publicly opposed the program with misleading information, fearing any challenge to their education monopoly regardless of how much children benefitted.

If Illinois enacts the Federal Scholarship Tax Credit program, low-income students could once again benefit from tax-credit scholarships to attend private schools or access additional educational support and remain in their public schools. They could gain academic support even if a home school is their best option.

7) The funds would help Illinois students stay competitive with students in other states

Thirty states and the District of Columbia have at least one private-school choice program, according to an analysis from Education Week. Those private-school choice programs are either educational savings accounts, vouchers, tax-credit scholarships, tax-credit educational savings accounts or direct tax credits. Seven Midwestern states have at least one private-school choice program.

Not having access to a private-school choice program puts Illinois students in the minority, at a competitive disadvantage and limits access to educational offerings that could better fit their needs.

Illinois shouldn’t put its students farther behind other states by denying families donated scholarship funds. If Pritzker opts in to the program, it gives Illinois the opportunity to join most states which already provide their students with funds for additional educational opportunities – at no cost to Illinois.

The bottom line: Illinois families in public, private or home schools could benefit from the donated scholarship funds. Taxpayers will get credit for their donations no matter what.

The only question is whether Pritzker will let the Illinois’ students benefit, or whether he will essentially hand the money to children in other states.