Each Chicago household on the hook for $82K in local government debt

After a tax hike spree from Chicago-area politicians, residents are stuck paying more only to carry an ever-larger load of debt.

Not only are Chicagoans’ taxes higher than ever, but local government debt has reached a record high as well.

Analysis of the city and its sister governments reveals each Chicago household is on the hook for $82,000 in local government debt. And until politicians get serious about structural reforms, that burden will only grow larger.

A heavy load to bear

Chicagoans are stuck with nearly $71 billion in official local government debt, up from $65 billion in 2015 – just two years ago.

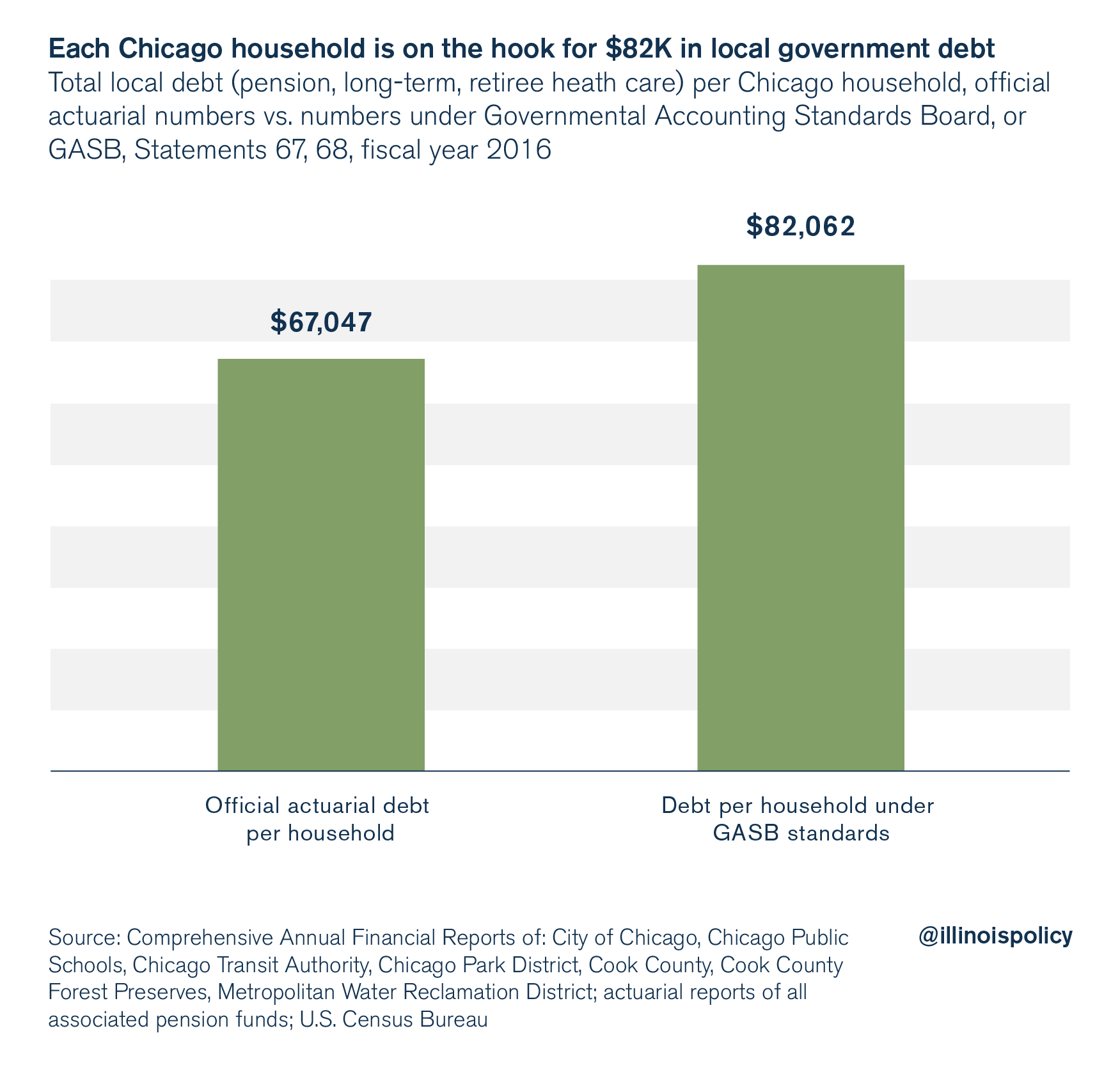

Chicago-area governments owe nearly $40 billion in official pension debt alone. And when Chicagoans’ share of all other local long-term and retiree health debt is added in, each Chicago household is on the hook for over $67,000 in official local government debt.

And Chicagoans’ burdens are even larger when one uses more realistic accounting standards.

Under those standards, every household in the city of Chicago is on the hook for $82,000 in debt.

In comparison, the annual median household income in Chicago is just $50,702 according to the U.S. Census Bureau.

Chicago’s four city-run pension funds – for police, firefighters, laborers and municipal workers – have over $25 billion in official unfunded liabilities. Those four pension funds alone are responsible for more than a third of the total local government debt Chicagoans face.

The city of Chicago itself also owes more than $12 billion in long-term debt.

And Chicago’s sister governments – Chicago Public Schools, the Chicago Park District and the Chicago Transit Authority – have $11 billion in pension debt and $12 billion in long-term debt, and owe another $2.3 billion for retiree health insurance costs.

Chicagoans are also on the hook for a little more than 50 percent of Cook County governments’ official pension, long-term and retiree health insurance debts, which total nearly $8 billion.

What’s worse, Chicago-area government debts are even bigger than the official numbers suggest.

According to more realistic accounting standards from the Governmental Accounting Standards Board, or GASB, Chicagoans are actually on the hook for $55 billion in pension debt, $16 billion more than local governments’ official numbers.

In total, Chicagoans are facing an $86 billion burden, according to GASB standards, or $82,000 per household. That’s not even including Chicago households’ liability for their share of the state of Illinois’ massive pension and other debts.

And that per-household number is in reality even higher. There are many households in Chicago that cannot afford to pay such debt – with members who are unemployed, fixed-income seniors, lower-income, etc. So the brunt of Chicago’s debt burden will fall on a select number of residents, particularly the city’s struggling middle class.

Overburdened and overwhelmed

Chicago-area politicians have gone on a tax hike spree over the last several years. They’ve hit Chicagoans with record property tax increases, new garbage collection fees, sales tax hikes and sweetened beverage taxes.

Chicago governments have all been trying to tax their way out of their structural spending problems at the expense of residents’ wallets. It hasn’t worked. And it’s made life worse for already-struggling city residents.

Chicagoans have been under heavy strain over the past decade. They’ve faced increased violence, weak jobs growth and the incompetence of Chicago-area governments. Residents continue to face higher taxes and fees – the highest in Illinois – as the dysfunction gets worse.

That’s forced residents of all stripes – from millionaires to middle- and working-class residents – to abandon the city in recent years. Not only did Chicago’s population shrink between 2000 and 2010, but the entire Chicago metro area has also shrunk for three years in a row. In all, Chicago’s population is at levels not seen since 1920.

But that decline matters little to politicians at both the state and city levels. Lawmakers still find it easier to pass the bill to taxpayers than to actually tackle the reforms necessary to fix the fundamental problems with government in Illinois.

Until the pension crisis is fixed through comprehensive reform and politicians stop borrowing to paper over short-term crises – Chicagoans will only see their tax bills go up and their debt burdens increase.

And the more Chicagoans are burdened, the more likely those who can leave will do so to find better opportunities elsewhere.