Failure: On the anniversary of Illinois’ 2017 tax hike

One year after a record-setting tax hike the state still can’t balance a budget, has done nothing to solve long-term fiscal problems and has further damaged its economic growth.

One year ago on July 6, Illinois lawmakers voted to override Gov. Bruce Rauner’s veto of a record-setting $5 billion permanent income tax hike. Individual tax rates rose to 4.95 percent from 3.75 percent, and corporate taxes jumped to 7 percent from 5.25 percent. That’s a 32 percent and 33 percent tax hike, respectively.

Looking back, it is clear the tax hike failed.

Illinois has done nothing but return to the tax-and-spend status quo and further damage a struggling economy. Even with the most state revenue in history, lawmakers failed to pass a truly balanced budget in the first and second fiscal year of the tax hike. The fiscal year 2018 budget is expected to end up $590 million in the red, according to the Governor’s Office of Management and Budget. And despite politicians’ claims to the contrary, the recently enacted fiscal year 2019 budget is not balanced either. In fact, it’s not really a budget at all: It’s an unfunded spending plan.

Lawmakers never passed a revenue estimate – a basic first step of budgeting – and are spending as much as $1.5 billion more than realistic revenue projections. Some of the gimmicks include: counting on $300 million for selling the Thompson Center for the third year in a row, banking $422 million in pension savings that – while generally good policy – is speculative at best in budgetary terms, ignoring $412 million in court-ordered backpay to government union workers, and using $800 million in fund sweeps and borrowing from other state funds.

To be fair, reform-minded elected officials are at a disadvantage in budget negotiations. Lawmakers seeking fiscal responsibility are playing a rigged game, controlled by Illinois House Speaker Mike Madigan, in a broken budget process.

Still, the substance of the budget package does nothing to address the state’s long-term fiscal challenges, including one of the nation’s worst unfunded pension liabilities and over $7 billion in unpaid bills at the end of the fiscal year. This failure to address long-term balance led S&P Global Ratings to say the spending plan “largely represents an extension of the status quo.”

Taxpayers now have all the proof they need that more tax hikes won’t solve Illinois’ problems.

Why the status quo is unacceptable in Illinois

In 2017, Illinois ranked 42nd in the nation in jobs growth and lagged behind all neighboring states. The 2011 tax hike cost the state economy $55.8 billion in real GSP growth and 9,300 jobs from 2012 to 2016. The 2017 tax hike will cause similar harm.

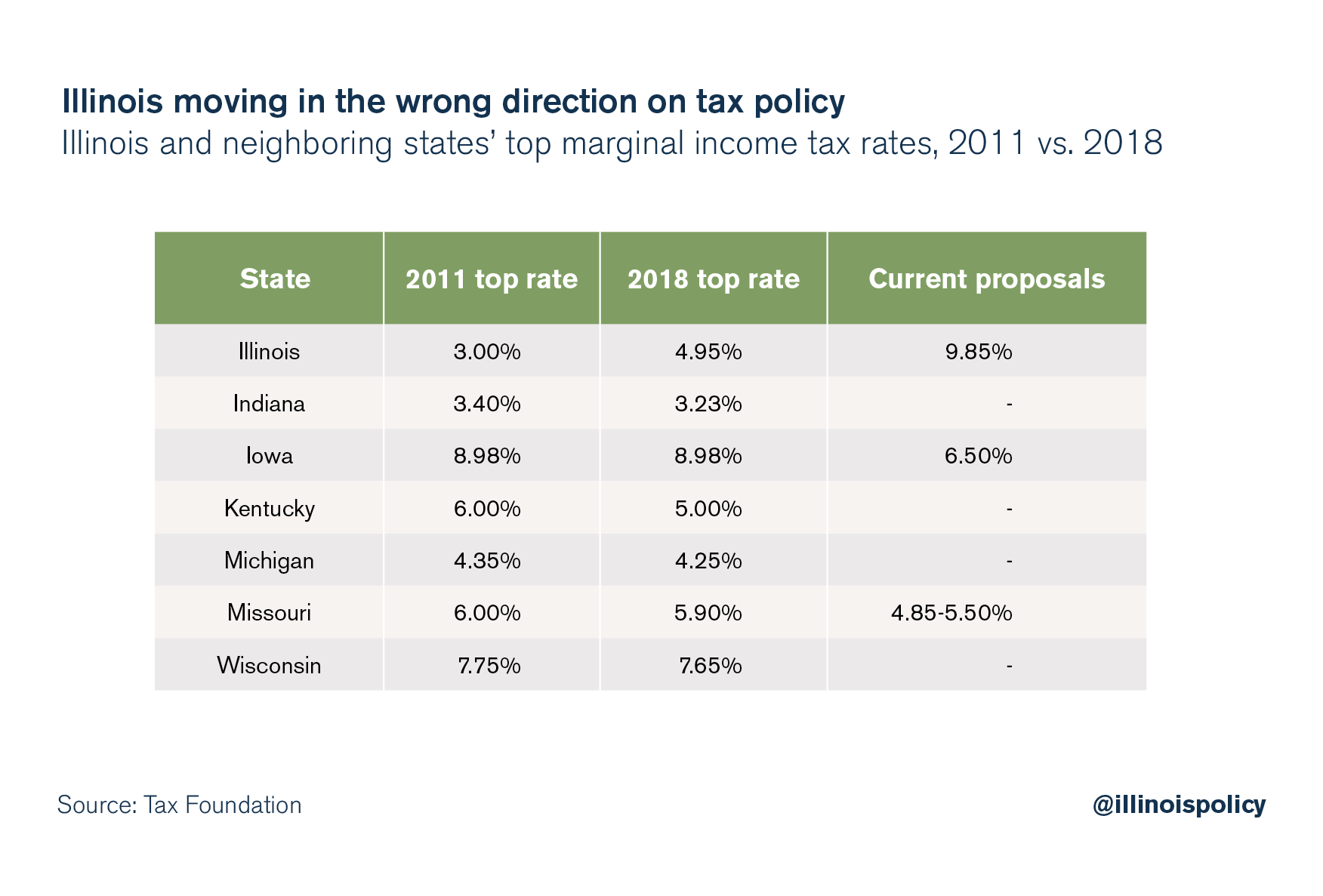

Tax hikes are a leading cause of this poor growth and make Illinois uncompetitive with neighboring states. Since the supposedly temporary tax hike in 2011, all six of Illinois’ neighboring states have cut their income taxes. It’s no coincidence that other states are better able to attract investment and grow jobs. Chief Executive Magazine recently ranked Illinois the 48th best state to do business in the nation.

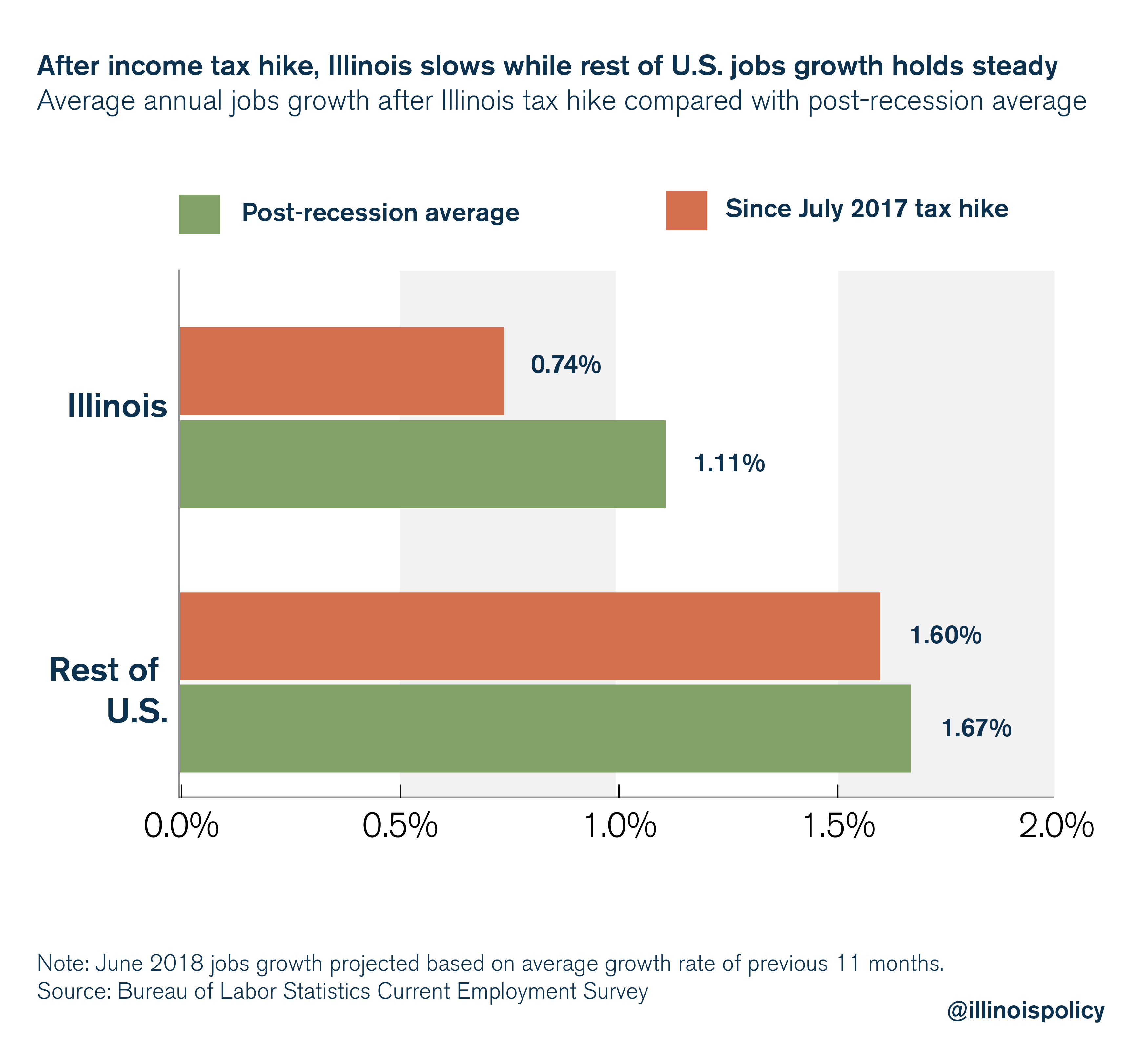

Looking back over the last year, it’s clear the latest tax hike is only making Illinois’ economic problems worse. Since the end of the Great Recession, Illinois has seen average annual jobs growth of 1.11 percent. But in the year since the income tax hike, Illinois’ employment growth was just 0.74 percent, a 34 percent decline.

Meanwhile, jobs growth in the rest of the U.S. remained constant relative to its post-recession trend.

Poor economic growth does real harm to real people. Illinois is in the midst of a migration crisis that is self-reinforcing: Prime working-age adults are leading the state’s population decline.

Illinois is a regional outlier because of policy choices such as the 2017 tax hike, and because some public figures are currently proposing hiking taxes even further under the guise of a progressive income tax. That’s a mistake.

Getting out of the hole: Reforms to ensure responsible spending and encourage economic growth

The first step to getting out of any hole is to stop digging.

Illinois lawmakers need to swear off future tax hikes as they attempt to solve the state’s challenges. Illinois does not have a revenue problem, it has a spending problem. State spending grew 25 percent faster than residents’ personal income from 2005 to 2015. Most of the growth in spending comes from dramatic increases in public sector union compensation and benefits.

According to the Governor’s Office of Management and Budget, growth in spending on government worker pensions and employee health insurance has far outpaced spending in every other area. From 2000 to 2018:

- Spending on pensions has grown 663 percent.

- Spending on employee health insurance has grown 215 percent.

- Spending on preschool through high school education has grown 65 percent.

- All other spending has grown by just 16 percent.

It is time to finally tackle the root of Illinois’ fiscal troubles: overspending. A proposed constitutional spending cap amendment received bipartisan support in the General Assembly this year. By tying annual growth in spending to the long-run average of growth in the state’s economy, a spending cap would make sure that Springfield cannot spend more than taxpayers can afford.

Lawmakers should build on the momentum of the constitutional amendment proposals by voluntarily adopting a spending cap as a budgeting principle, while working toward a change in the Illinois Constitution. To ensure the cap is met, lawmakers need to structurally reform spending on the key cost drivers of the state budget.

Combined with meaningful economic reforms to grow the state’s economy and end the outmigration crisis, spending restraint would put Illinois on a path to get rid of crippling debt and provide tax relief for struggling Illinois residents.

Looking ahead, there’s a good chance whoever is elected governor this November will face a mid-year budget hole in January. Fitch Ratings has even predicted lawmakers and the governor may need to reconvene to fix holes in the budget as early as this fall. What strategies will be used to close the fiscal gap remains to be seen, but one thing is certain: If the definition of insanity is doing the same thing over and over again and expecting different results, it would be insane to hike taxes again.