Tax hike to balance budget shortfall could cost Illinois’ economy 9,000 jobs

By Orphe Divounguy, Bryce Hill

Tax hike to balance budget shortfall could cost Illinois’ economy 9,000 jobs

By Orphe Divounguy, Bryce Hill

Illinois lawmakers have officially adopted a budget for fiscal year 2019.

The 1,245-page bill was made public less than five hours before state senators cast their votes and exceeds realistic revenue projections by as much as $1.5 billion. While closer to balanced than many Illinois budgets, the spending plan fails to enact meaningful reforms to rein in the cost of government.

As it stands, this year’s budget can be expected to negatively affect Illinois’ already fragile economy. In the worst-case scenario, closing a budget shortfall of $1.5 billion with an income tax hike could depress productivity growth by nearly $700 million and employment by the full-time equivalent of 9,000 jobs.

Hiking taxes to address unbalanced budgets will force Illinois down the same path of continuous tax hikes and sluggish economic growth that it has tread for years. But an alternate path of spending restraint and pension reform would give businesses and families the certainty they need to invest in the Prairie State.

Introduction

The fiscal year 2019 budget marks the first time in three years that Illinois lawmakers have passed a budget by the close of the legislative session at the end of May. Nonetheless, the fiscal year 2019 budget fails to meet key requirements under the Illinois Constitution: It must be based on an official revenue estimate and it must be balanced. In fact, lawmakers haven’t agreed on an official revenue estimate since 2014 or passed a truly balanced budget since 2001.

Over the last decade, Illinoisans have endured two income tax hikes, two years of budget gridlock, one of the heaviest property tax burdens in the nation and one of the country’s worst public pension crises. This has eroded the confidence of investors and residents, and Illinois’ population has declined for the past four years, leaving a shrinking tax base on the hook for growing debt obligations from Springfield and local governments.

In order to finance state spending that grew 25 percent faster than Illinoisans’ personal incomes from 2005 to 2015, the General Assembly passed the largest permanent income tax hike in state history in 2017.

Despite having more revenue from state sources than ever before, lawmakers in Springfield have spent every last penny, and then some – without seriously addressing the state’s debt or reforming the cost drivers that help make balanced budgets such a rare occurrence in Illinois. This means the budget fails to give taxpayers and potential investors much-needed reassurance that the long-term fiscal health of the state is on the right track.

Unfortunately, Illinois’ new budget doesn’t adequately address the state’s growing debt, and could, in fact, add to it. The governor could attempt to use executive action to significantly narrow the deficit as he did for fiscal year 2018, but if this proves impossible, lawmakers could seek to enact more tax hikes on Illinoisans. And if the General Assembly resorts to hiking taxes to cover the budget shortfall, taxpayers will suffer even beyond the extra dollars taken out of their paychecks.

What a tax hike to balance the budget would mean for Illinois’ economy

If Rauner is unable to balance the budget through executive action, and some of the speculative cost savings in the budget don’t come to fruition, lawmakers will be in search of anywhere from $635 million to $1.5 billion in additional revenues. This money will likely come straight out of taxpayer pockets, potentially in the form of another income tax hike.

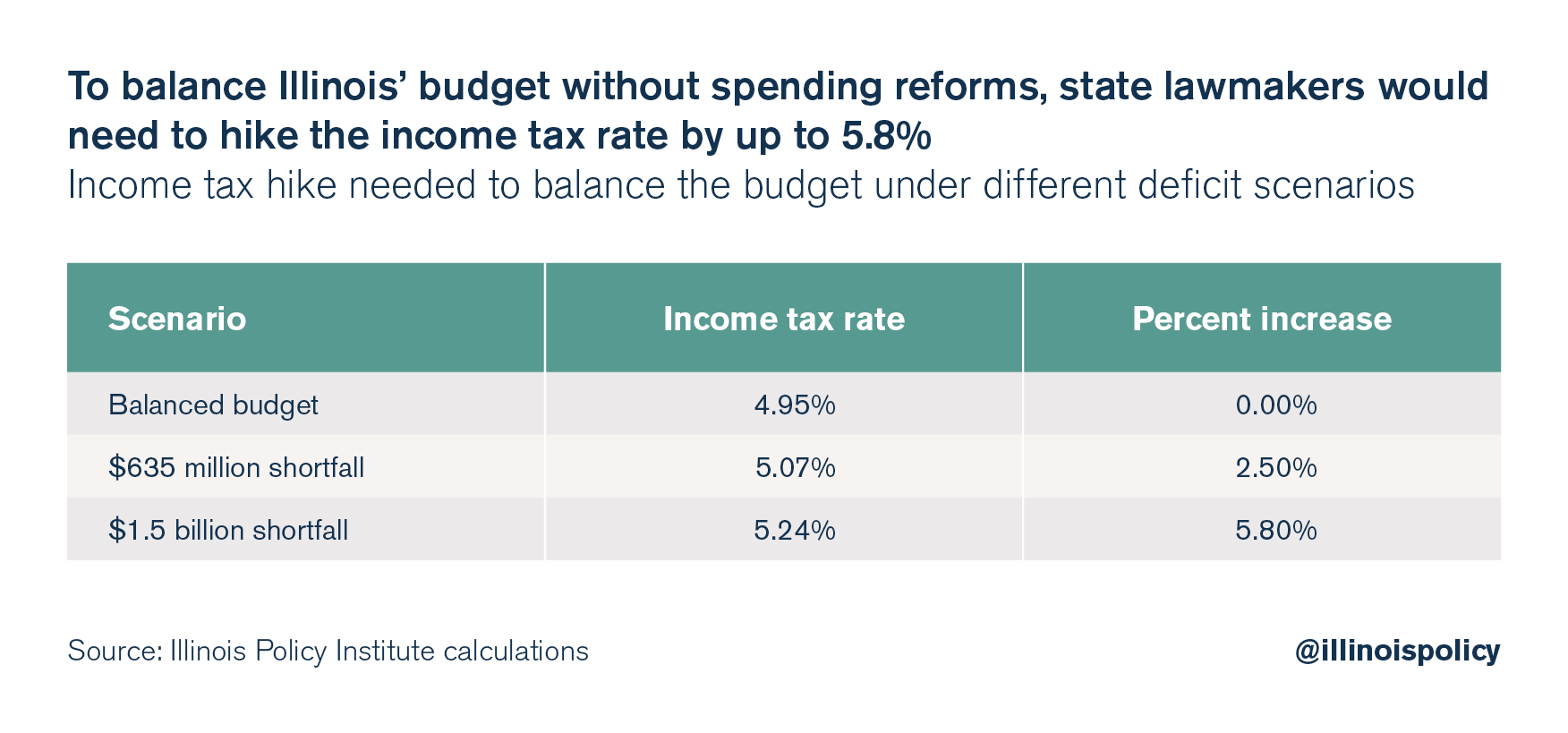

When taking into account the predictable responses of individuals, businesses and investors to changes in tax policy, Illinois Policy Institute calculations reveal that to balance the budget without restraining spending, lawmakers would have to increase the income tax burden by 2.5 percent to nearly 6 percent.

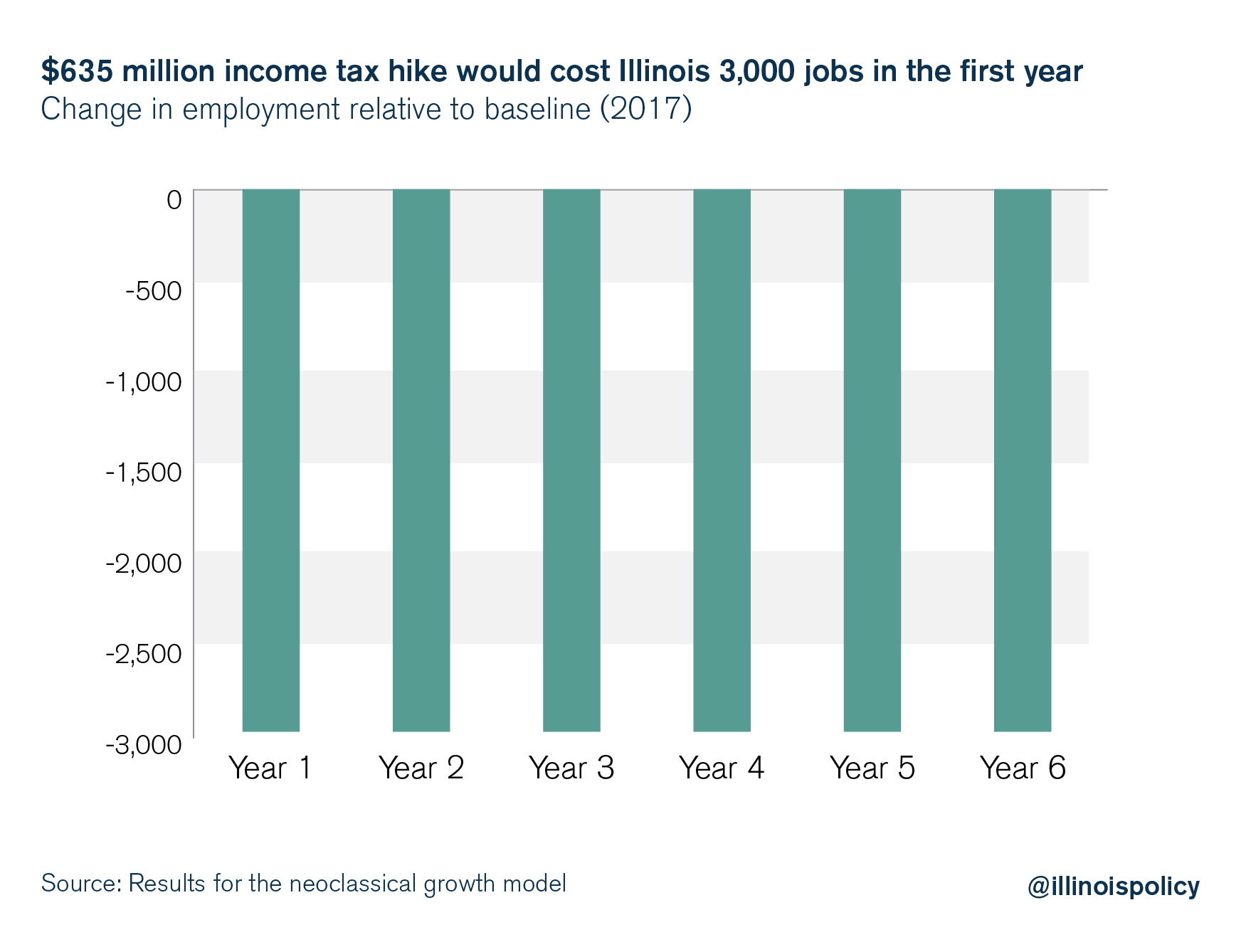

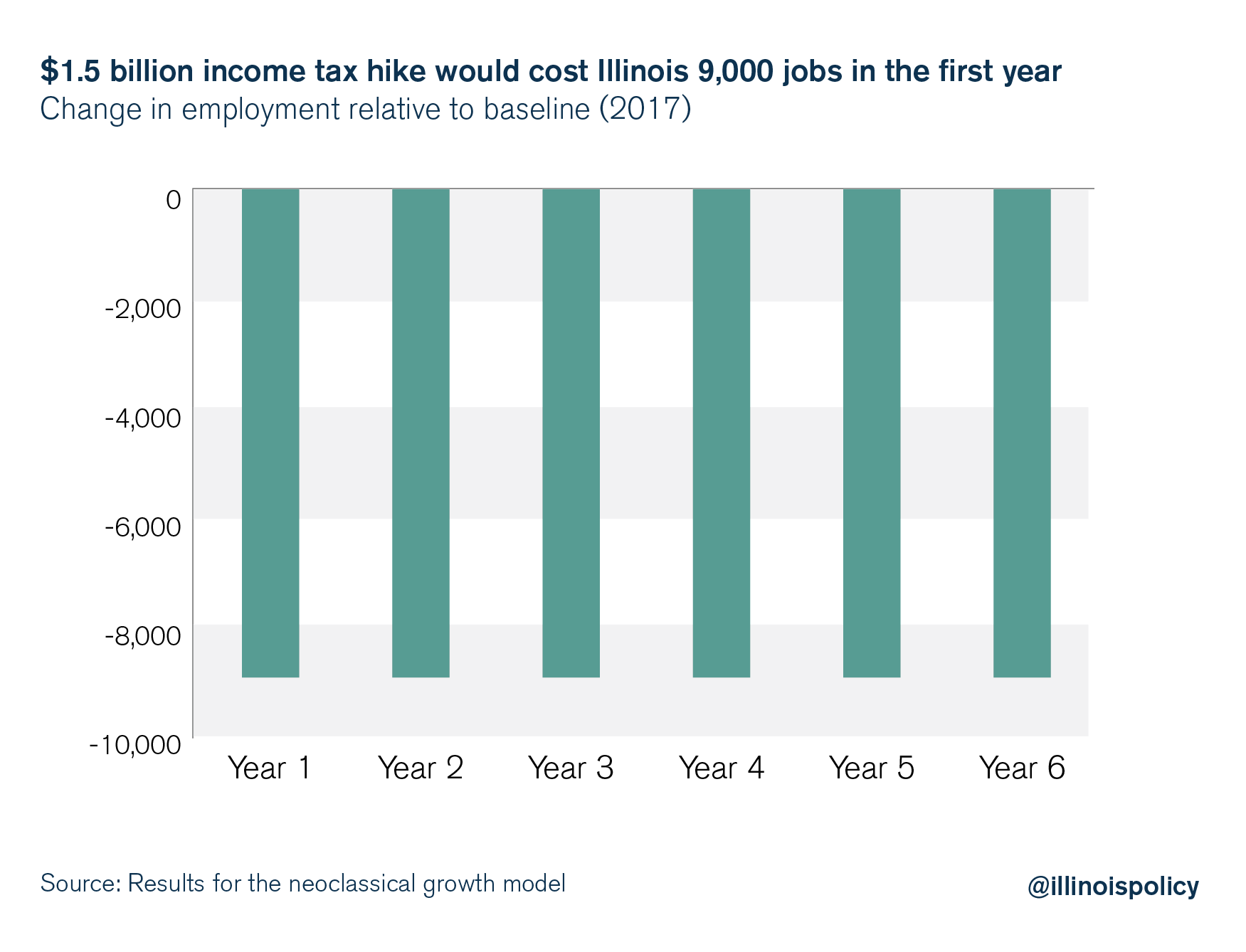

Depending on the amount of revenue ultimately needed to balance the budget, in the absence of spending cuts, the state could have to hike income taxes anywhere from $635 million to $1.5 billion. The magnitude of the impact of each of these potential scenarios depends on the change in the tax burden, but each scenario would have a negative impact on employment.

In the best-case scenario, a $635 million income tax hike could depress employment by the equivalent of 3,000 full-time jobs (see Appendix B).

Meanwhile, a $1.5 billion income tax hike could mean 9,000 fewer new full-time jobs.

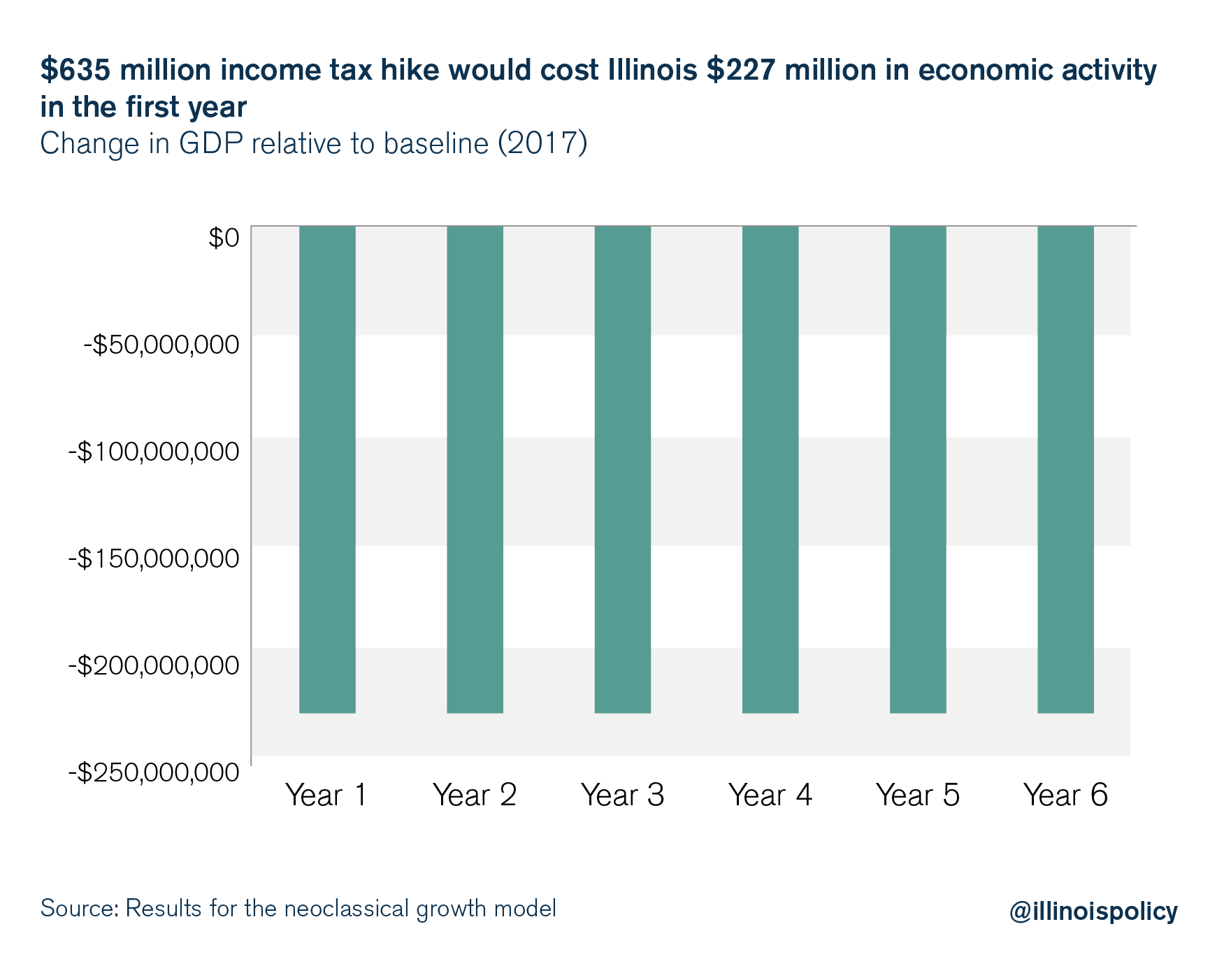

In addition to jobs growth, there are also implications for Illinois’ already-fragile state economy. A $635 million income tax hike would harm productivity and cost the state $227 million in economic activity in the first year alone.

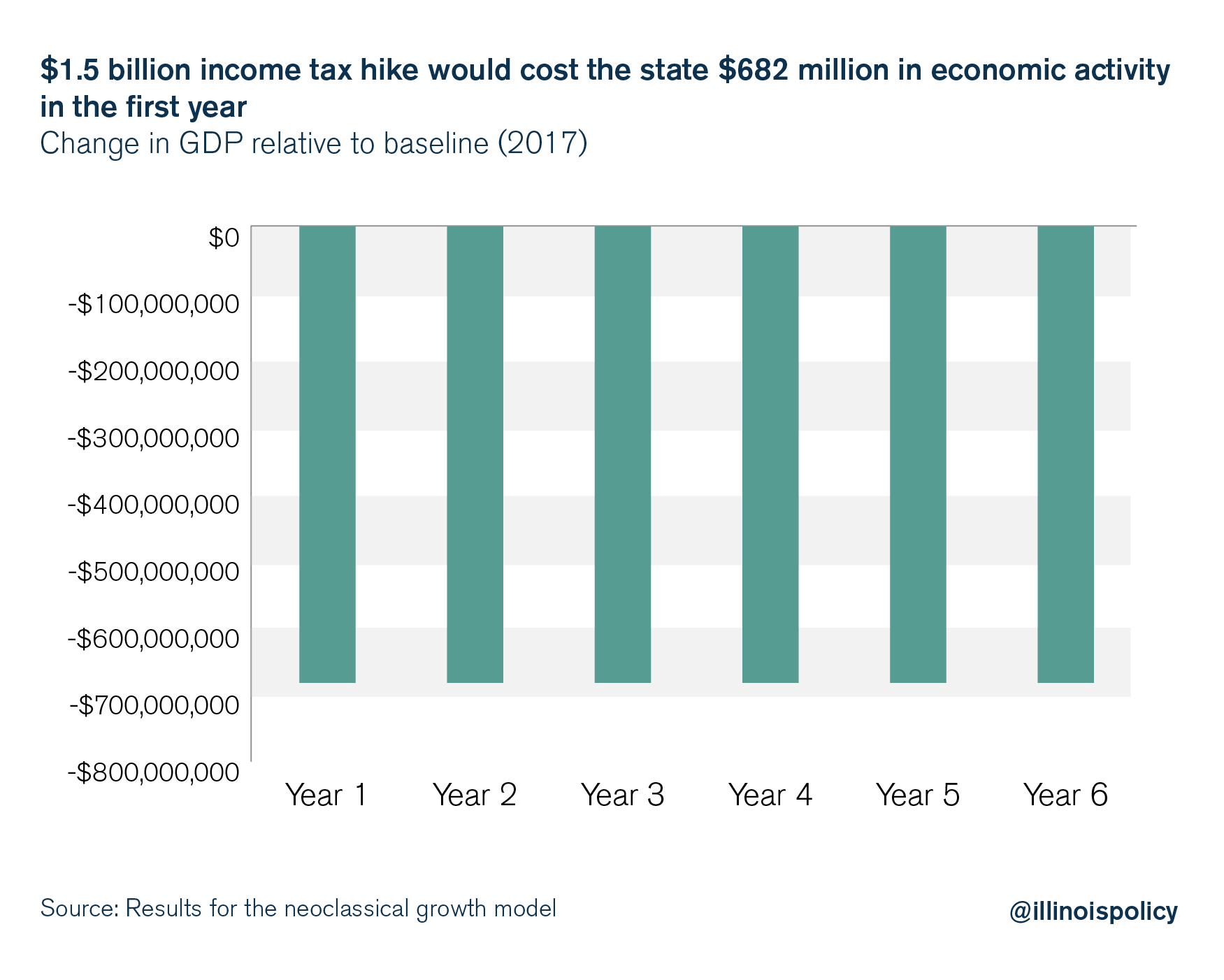

Meanwhile, a $1.5 billion income tax hike would cost the state $682 million in economic activity in the first year alone.

Long-run impact of a tax hike on economic activity

Under the assumption of perfectly competitive markets, the long-run cost of an income tax hike to finance Illinois’ budget deficit could be an economy that grows by $1.36 billion less than it would have without a new tax hike.

Relaxing this assumption by doing away with perfectly competitive markets to assume more realistic imperfect competition, where all profits accrue to firm owners, the tax increase would have a larger negative impact on economic activity. This is consistent with Mankiw and Weinzierl (2006), who show that under imperfect competition, the feedback effects of taxation are much larger than in the case of perfectly competitive markets.

Assuming markets are not perfectly competitive, the state could see a $1.49 billion contraction in economic activity over the long run, after production adjusts to the new tax environment.

Additionally, both of these estimations of declines in economic activity are likely on the low side, because they assume no changes in the long-run interest rate, which is currently at a near-historic low given the overall U.S. employment picture. If interest rates were to rise to their historical average of 4 percent, the combination of the income tax hike and a rise in borrowing costs would be significantly more harmful for Illinois’ economic expansion.

What this means for Illinoisans

Though there are a variety of plausible outcomes in terms of the magnitude of the impact of this year’s budget, if lawmakers covered a shortfall with another income tax hike, all Illinoisans would suffer.

An income tax hike would harm employment in the Land of Lincoln. Although the state has already failed to keep pace with the rest of the nation in terms of job creation, in no small part because of the two multibillion-dollar income tax hikes since the end of the recession, financing a budget deficit through an income tax hike would make matters even worse. Illinoisans already find it harder to find a job here and unemployed Illinoisans spend more time looking for a job than unemployed workers in other places across the country. In fact, Illinoisans spend, on average, four more weeks unemployed than people in the rest of the nation, according to government data.

The uncertainty that this year’s budget creates will not help to improve these numbers. Furthermore, any tax hike resulting from this budget will mean less economic potential because of a decline in investment that lowers productivity.

Historically, productivity growth has led to gains in compensation for workers and greater profits for firms. A tax hike that lowers labor productivity – output per hour – is a tax on living standards and quality of life for all Illinoisans.

Changing course

The Illinois Policy Institute has proposed a path to balancing the budget that requires no tax increases. One key policy solution the Institute offered for fiscal year 2019 is a spending cap, which would limit the growth in government spending to the long-run average growth rate of the state economy. Tying government spending to economic growth protects taxpayers from future tax hikes. Democrat and Republican lawmakers proposed spending cap constitutional amendments in both the Illinois Senate and the House this year.

Although these amendments did not made it to a vote, lawmakers could have voluntarily adopted the spending cap for fiscal year 2019, which would have allowed for a budget that spent $36.9 billion instead of $38.5 billion. The spending cap would have allowed spending that would be nearly $1 billion under the Commission on Government Forecasting and Accountability, or COGFA, revenue estimate for 2019. This would have allowed the state to start to pay down its backlog of bills and its pension debt, rebuild the rainy day fund and begin to consider long-term tax relief.

The governor’s proposed 2019 budget would have allowed for $37.6 billion in spending, still coming in slightly below COGFA’s revenue estimate. Both of these potential budgets would have met the most fundamental goal of budgeting – spending within one’s means.

Unfortunately, that is something lawmakers in Springfield have failed to do for quite some time, leaving taxpayers holding the bag.