Out of ideas: Political insiders push for a $30 billion tax hike

The Civic Federation is pushing a $30 billion tax hike in Illinois, following the same mistaken path that got Illinois in today’s fiscal crisis.

Nationally, Illinois is known as a financial disaster. The state has the biggest pension crisis in the nation, the worst credit rating of any state, over $7 billion in unpaid bills, and a budget that’s unbalanced by at least $4 billion.

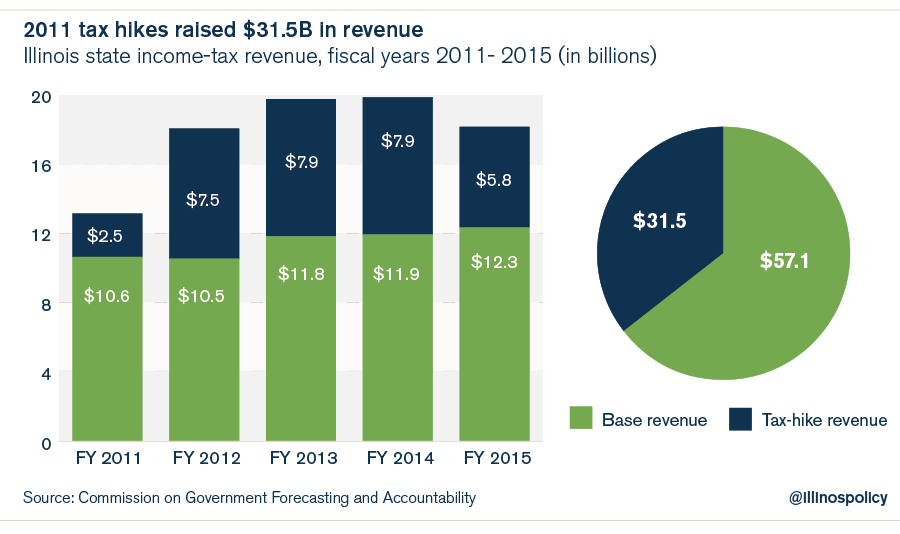

Illinois’ failed 2011 income-tax hike proved just how reckless state politicians can be. Taxpayers were forced to hand over more than $31 billion in additional taxes under the promise that politicians would fix the pension crisis, pay down Illinois’ unpaid bills, and turn around Illinois’ economy. But filling Springfield’s coffers only allowed politicians to avoid the spending reforms necessary to turn around Illinois. No significant reforms were passed during those four years, and Illinois is now in worse financial shape than it was before the tax hike.

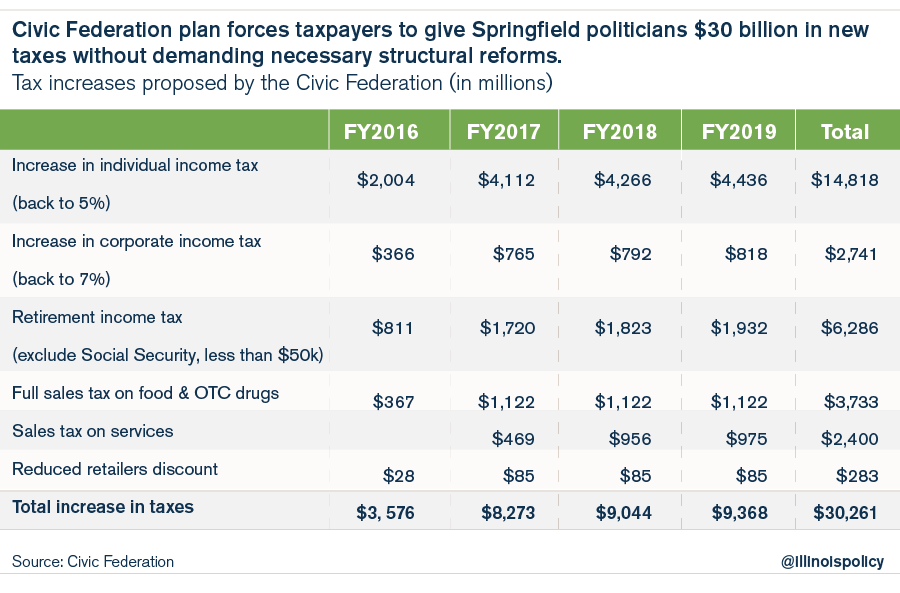

Now the Civic Federation, a research organization that represents Chicago-area corporations and professional firms, wants to repeat the same policy mistakes that got Illinois here in the first place. Its recommendation? A $30 billion tax hike on Illinoisans. Not only does the Civic Federation avoid holding lawmakers accountable for their failures, but it wants to reward the General Assembly for its reckless behavior. The Civic Federation’s plan is to give politicians $30 billion of taxpayers’ dollars without first demanding structural reforms.

The Civic Federation’s $30 billion in new taxes

With the last income-tax hike, taxpayers sent an additional $31 billion to Springfield; the politicians who passed the tax hike promised the revenue would fix Illinois’ fiscal problems.

Instead, state lawmakers used that infusion of income-tax-hike cash to avoid significant spending reforms and grew the budget instead.

Now the Civic Federation is proposing to do the same thing all over again.

In a repeat of last year’s FY 2016 Budget Roadmap, the Civic Federation’s plan calls for six major tax increases:

- Retroactively increasing the state individual income tax back to 5 percent, up from 3.75 percent

- Retroactively increasing the state corporate income tax back to 7 percent, up from 5.25 percent

- Begin taxing retirement income, excluding Social Security income, above $50,000

- Imposing the state sales tax on services

- Imposing the state sales tax on food

- Imposing the state sales tax on nonprescription medicine

Collectively, these proposed taxes would take another $30 billion from taxpayers’ wallets through 2019.

Considering how much damage the $31 billion income-tax hike has already done to Illinois’ taxpayers and the state’s economy, it would be foolhardy to make the exact same mistake twice.

The last tax hike crushed Illinois

The Civic Federation’s recently released FY 2017 Budget Roadmap is a repeat of the same failed strategy the state embarked upon five years ago: tax hikes now with promised structural reforms later.

Back in 2011, Illinois’ politicians enacted a record 67 percent personal-income-tax hike and a 46 percent corporate-income-tax hike during a lame duck session. Springfield politicians promised the additional revenue would stabilize the pension crisis, pay down the state’s unpaid bills, and help the economy.

The hike accomplished just the opposite: The pension crisis wasn’t fixed, Illinois’ bills weren’t paid off, and Illinois suffered the weakest economic recovery in the nation. Even worse, Illinoisans left the state in record numbers – to the point where Illinois actually lost population in 2015.

Here are three ways the last tax hike failed and left Illinois worse off:

1. Illinoisans have left in record numbers

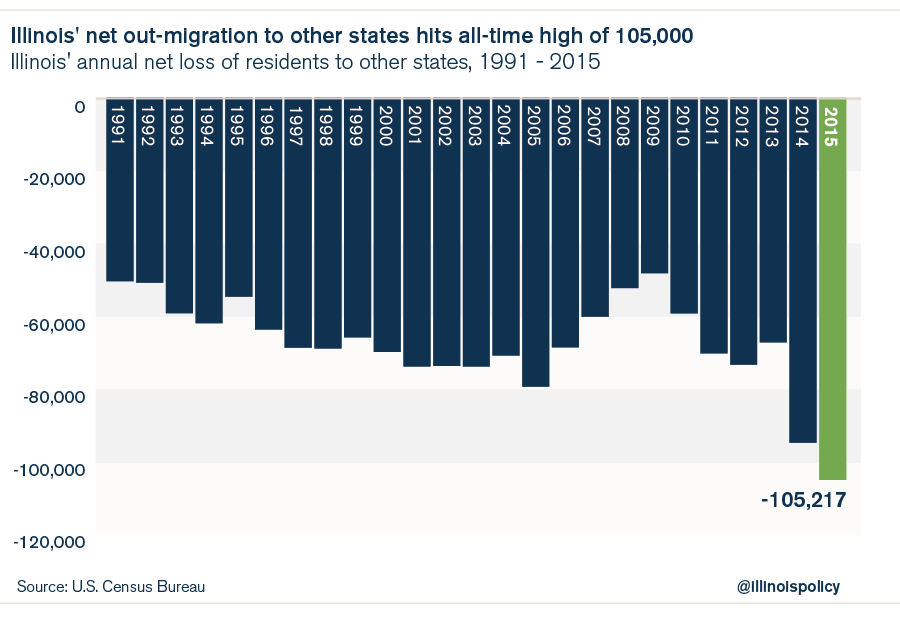

The most destructive legacy of the 2011 tax hike has been out-migration and a steady dissolution of Illinois’ tax base.

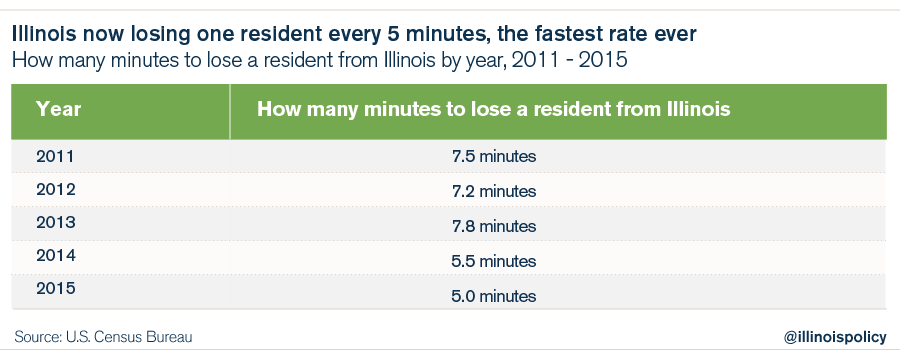

Since the tax hike, residents have been leaving Illinois in record numbers. Between 2011 and 2013, a net 200,000 people left Illinois and took over $10 billion in taxable income with them.

One Illinoisan left the state, on net, every 5 minutes in 2015.

In all, Illinois netted a record loss of 105,000 residents in 2015.

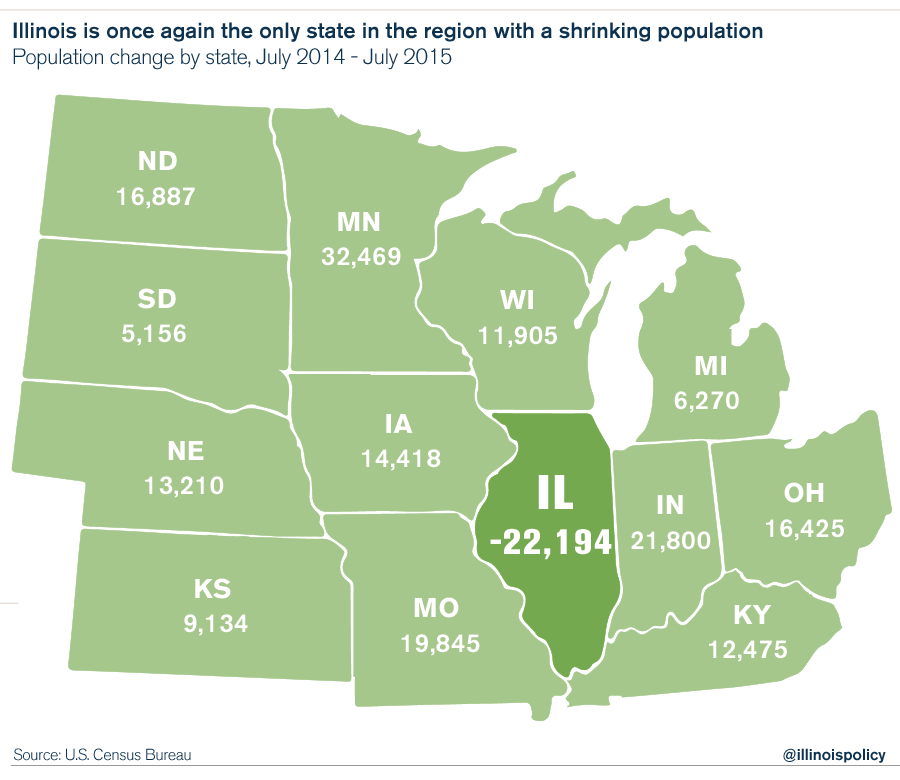

As a result, Illinois’ population actually shrank last year. Illinois lost over 22,000 people, the only state in the Midwest to do so.

People’s biggest reason for leaving: employment. That’s something the Civic Federation’s plan does not address. The group’s plan doesn’t focus on pro-growth and spending reforms that would help put Illinoisans back to work. In fact, it only gives struggling Illinoisans more reasons to leave the state.

2. Illinois’ pension crisis grew worse by $30 billion

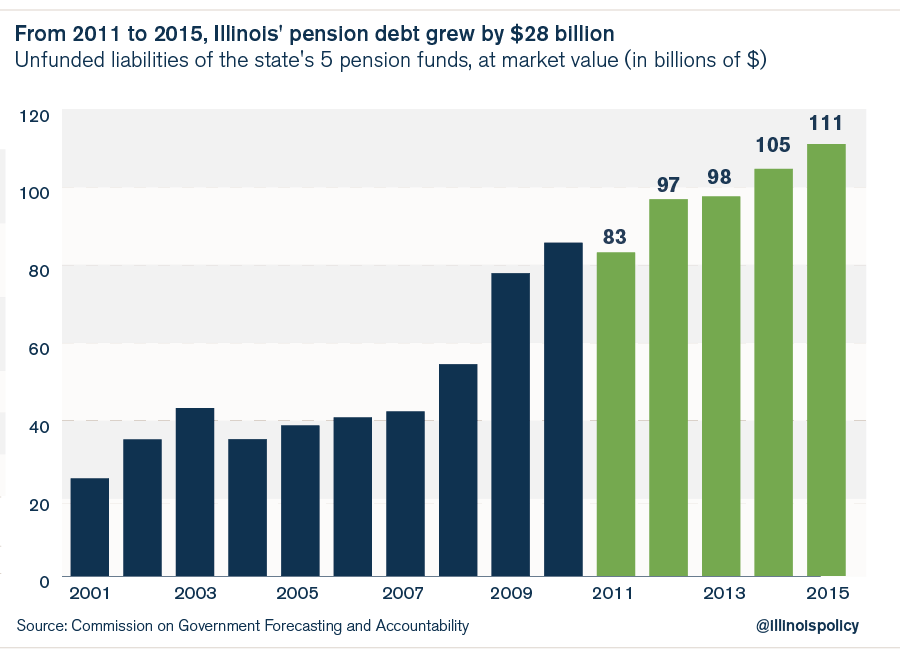

One of the justifications Illinois’ politicians gave for enacting the 2011 tax increase was that the money would help pay down a portion of the state’s pension debt.

To that end, politicians poured 90 percent of the tax hike’s $31 billion in revenue into the pension funds.

The result: Illinois’ pension debt actually grew by $30 billion, and the state’s pension funds are worse-off than ever before. In fact, the funds have just 40 cents on hand for every dollar they need to pay out current and future benefits.

Pouring more money into the state’s broken pension system is clearly not the answer. Until state pensions undergo real reform, more and more state funding is going to be siphoned away from core spending – such as on K-12 and higher education – and toward the pension funds.

3. Illinois’ unpaid bills remained unpaid

Paying down Illinois’ growing pile of unpaid bills was another justification for the 2011 tax hikes. In 2011, Illinois had an $8.5 billion bill backlog that Illinois politicians promised would be paid down.

But by 2014 – long before the current budget stalemate began – Illinois still had a $7 billion bill backlog.

For all the harm the income-tax hike did to Illinois’ taxpayers and economy, the proceeds barely touched Illinois’ unpaid bills.

Illinois needs real reform, not tax hikes

The Civic Federation, which represents Chicago-area corporations and professional firms, is giving taxpayers advice its own private-sector members would never follow.

A private-sector firm would never invest capital in a corrupt, fiscally unsound company without first demanding major reforms, changes in governance, and additional oversight.

But that’s exactly what the Civic Federation is recommending to taxpayers – bail out the failed and irresponsible policies of Illinois’ political class that have nearly bankrupted Illinois. The Civic Federation is acting as an agent of the status quo – asking for more from taxpayers without demanding the reforms – fiscal, economic and governance – that could actually change Illinois for the better.

The Civic Federation should demand Springfield enact necessary reforms first, before any additional tax hikes on Illinoisans are even discussed. Those reforms include:

- Passing regulatory reforms to fix Illinois’ broken workers’ compensation system and anti-business lawsuit climate

- Freezing local property taxes while granting local governments more control over their own collective-bargaining agreements

- Moving new state workers to 401(k) retirement plans and other commonsense pension reforms Illinois can enact without passing a constitutional amendment

- Making Illinois lawmakers reform their own pension fund, the General Assembly Retirement System, and move themselves onto 401(k) plans going forward

- Making local school districts and public universities bear the pension costs of their own employees going forward

- Requiring all local school district employees to make contributions toward their own pensions by ending teacher pension “pickups” as an employee benefit

- Eliminating the state’s broken education-funding formula and creating a money-follows-the-student model in its place

- Requiring state universities and community colleges to enact spending reforms to eliminate bloated administrative staff and lower the cost of tuition

- Reducing the cronyism inherent in Illinois politics by passing term-limits and redistricting amendments

Until these and other major reforms are signed into law, neither Illinois politicians nor the Civic Federation has any right to ask taxpayers for another penny.