10 reasons Illinois needs a new approach

The status quo isn’t working for Illinois; the state needs serious reforms to get its spending under control, pay down its debt, and rein in the taxes that are driving its people across state lines.

Illinois certainly needs a budget. But it needs much more than that.

It needs solutions.

Whatever budget is passed, it must address and begin to solve the chronic, painful issues Illinoisans face every day – from job losses, to the highest property taxes in the nation, to the state’s hostile environment for businesses. If not, Illinoisans will continue to flee Illinois in record numbers.

As the legislative debate rolls on regarding the Illinois Senate budget plan introduced in early January by Senate President John Cullerton, D-Chicago, and Senate Minority Leader Christine Radogno, R-Lemont, everyone, from the press and politicians to civic groups and taxpayers, must ask this question: Does the proposal address the fundamental crises facing Illinois?

If a plan is full of tax hikes, borrowing and bailouts, then it will only perpetuate the disastrous status quo of the last several decades, and Illinois’ crises will continue.

On the other hand, if a plan contains concrete, structural reforms – from 401(k)-style retirement plans, to comprehensive property tax reform, to revamped workers’ compensation rules and changes to collective bargaining and Medicaid – then Illinois will finally be tackling its many problems.

Unfortunately, the Senate plan is far closer to the former than the latter. If it is enacted, Illinoisans can only expect the failures of the past few decades to continue.

Here are 10 negative consequences of Illinois’ status quo:

- Illinois has created no new net jobs since 2000

Illinois has not had a net gain in private-sector jobs in nearly 17 years. The state is still short 22,000 jobs compared with the year 2000.

In contrast, every one of Illinois’ neighboring states has created private-sector jobs over the same time period. Indiana has created over 75,000 net jobs, while Wisconsin has created over 80,000.

And Texas has created more than 2 million net new jobs over the same time frame.

- The state has suffered a collapse in manufacturing jobs

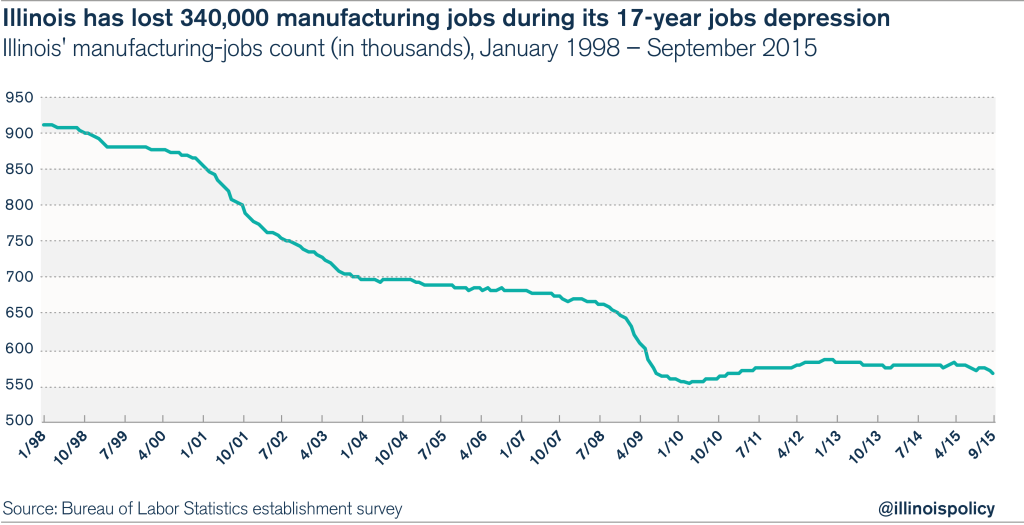

Unlike other states in the Midwest, where manufacturing has largely recovered from the Great Recession, Illinois’ manufacturing sector has continued on a downward spiral. Illinois manufacturing jobs have grown less than 3 percent since the bottom of the recession. Iowa has recovered double that. Wisconsin has grown its manufacturing jobs by 12 percent. Indiana and Kentucky have grown their jobs by over 20 percent. And Michigan has grown its manufacturing jobs by almost 40 percent.

Overall, Illinois has lost over 300,000 manufacturing jobs since 1998, causing great economic harm to middle-class and blue-collar residents in downstate communities that depend on those jobs.

- Illinoisans are burdened with the highest property taxes in the country

Illinoisans today pay the highest property taxes in the nation when compared with the value of their homes. The average Illinoisan pays 2.67 percent of the value of his or her home in property taxes every year – double what homeowners in Missouri pay and 2.5 times what residents in Indiana and Kentucky pay.

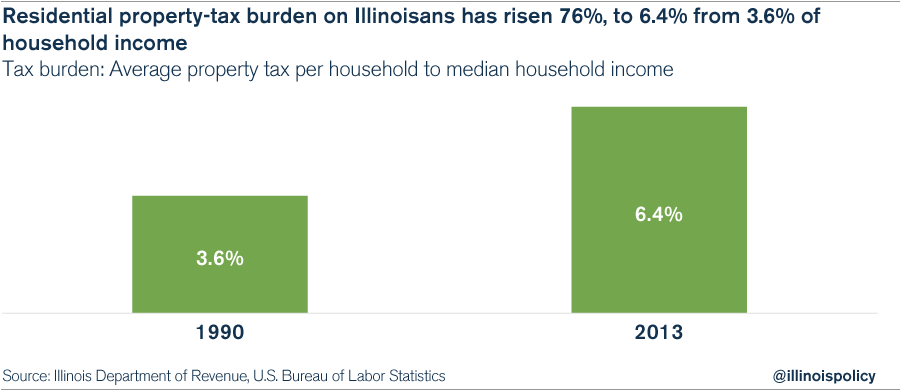

And property taxes are taking a bigger and bigger chunk out of homeowners’ wallets. Property taxes consumed 6.4 percent of Illinoisans’ median household incomes in 2013. That’s nearly double the 3.6 percent property taxes consumed in 1990.

In some Illinois communities, residents pay 5 percent or more of the value of their homes in property taxes. For many, that’s more than they pay toward their mortgages each year. In those places, such as in Chicago’s Southland area, a homeowner will pay twice for his or her home over a 20-year period: once to purchase the home and a second time in the equivalent amount of property taxes.

- The state hasn’t balanced its budget since 2001

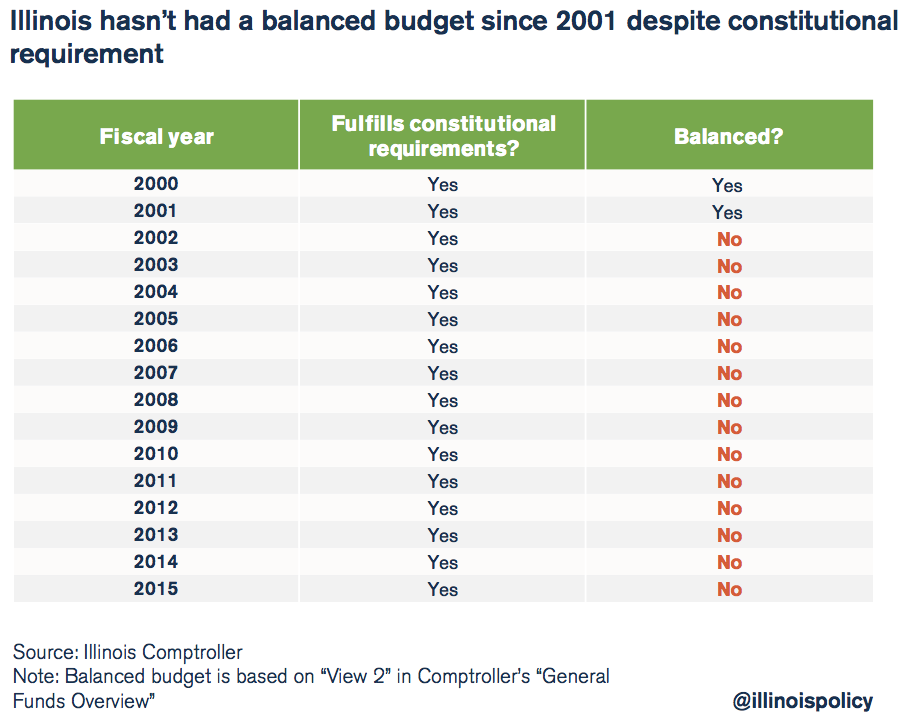

Any state with an absence of structural spending reforms and an economy that loses people and jobs to more business-friendly states will always struggle to balance its budget.

The state hasn’t had a truly balanced budget since 2001 despite a constitutional requirement to do so. Politicians have put off paying bills, moved funding around and engaged in other budgetary gimmicks every year since then.

- Illinois continues to borrow money at a rapid pace

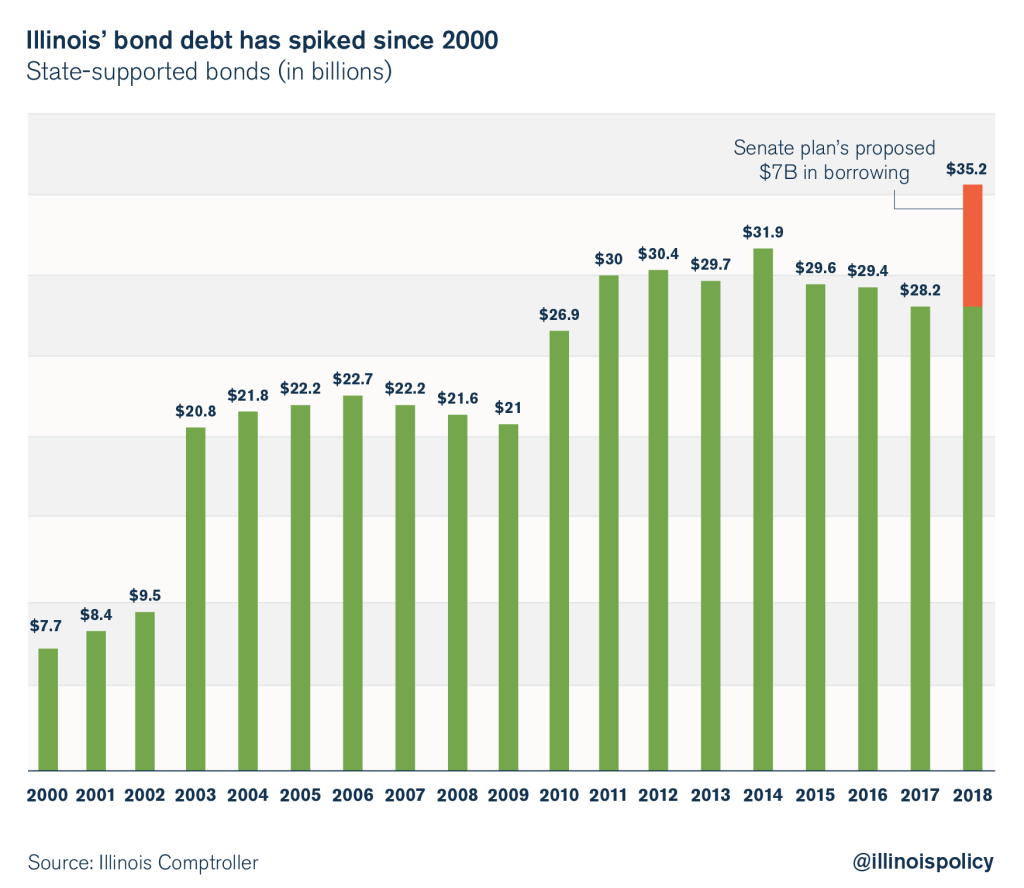

Future generations are increasingly on the hook for the government’s spending negligence. The state’s debt has quadrupled to over $28 billion since 2000, meaning interest and debt payments are now siphoning money away from core government services such as education and social services.

The Senate plan would add another $7 billion in borrowing, increasing the state’s debt burden to over $35 billion.

- The state’s credit rating has collapsed

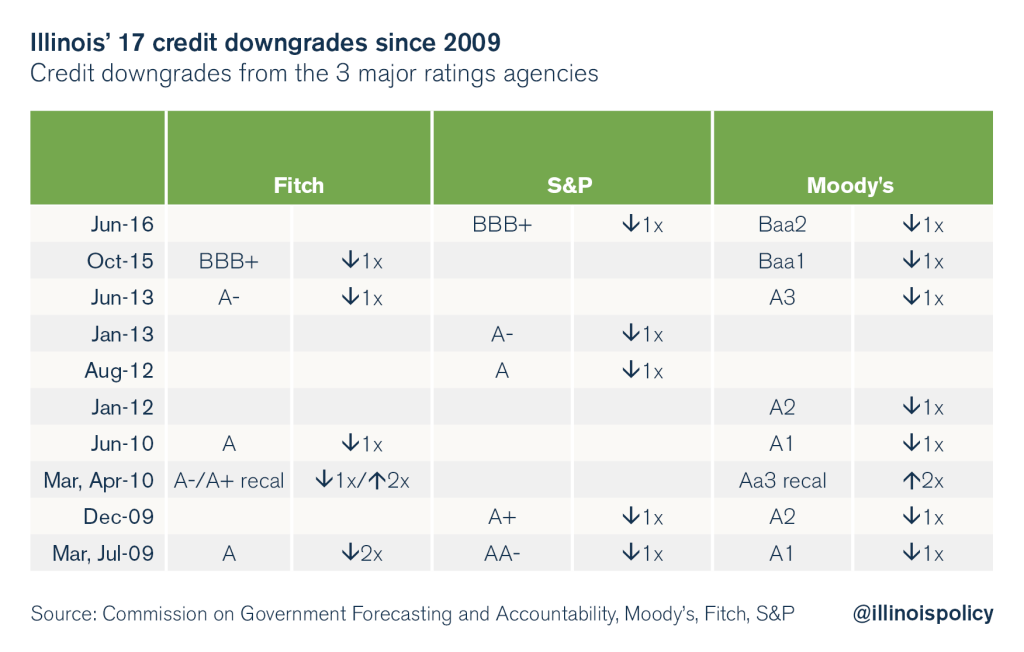

The state’s chronic history of bad budgets, spending priorities focused on state workers, and the refusal to pass spending and pension reforms has resulted in financial institutions continuously punishing Illinois with credit downgrades year after year. Since 2009 alone, Illinois has suffered 17 credit downgrades from among the nation’s three big ratings agencies.

Moody’s Investors Service has assigned Illinois the lowest credit rating in the country, just two notches above junk bond status. The credit rating agency has warned that the exodus of people from Illinois and the state’s weak economy are credit negative – an indication that the state risks falling into a financial death spiral.

- Illinois’ pension crisis continues to grow uncontrollably

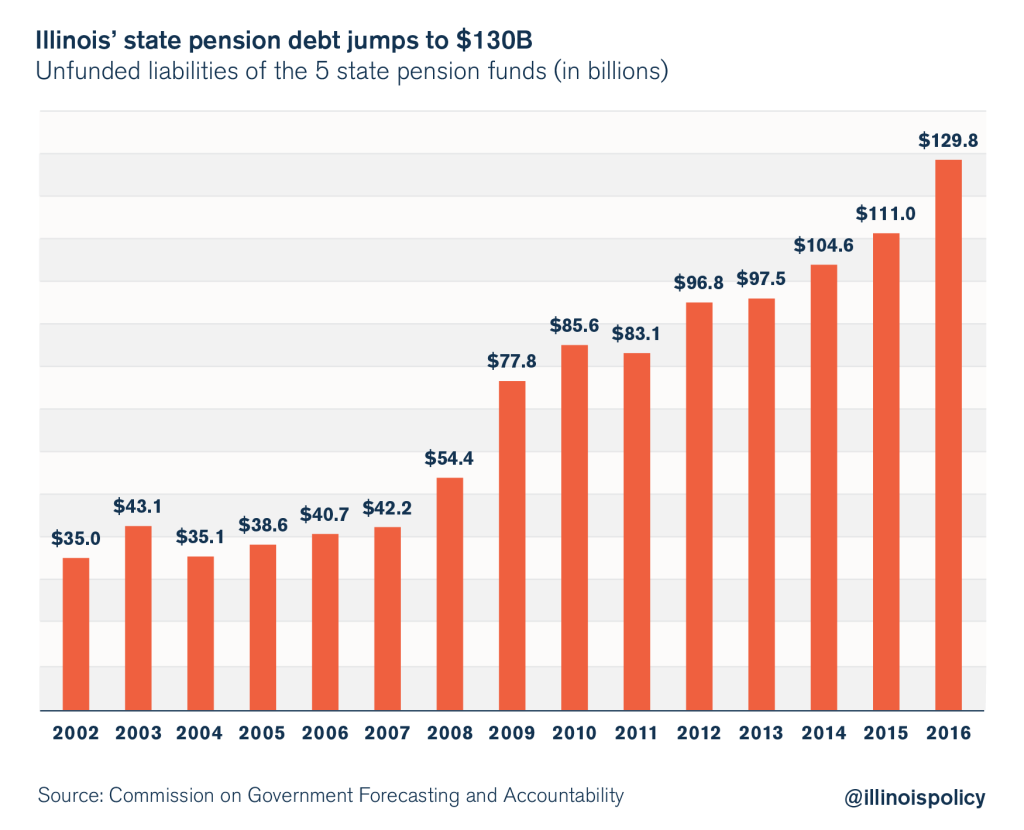

Under conservative projections, the state owes a record $130 billion in pension debt, bringing state worker retirements to the brink of insolvency.

Illinois’ pension debt has more than tripled since 2002. In that year, Illinoisans owed $7,600 in debt per household. Today, households in Illinois are on the hook for more than $27,000 each in state pension debt. That number has worsened as pension benefits grow and Illinois’ population shrinks.

- Skyrocketing benefits continue to fuel the pension crisis

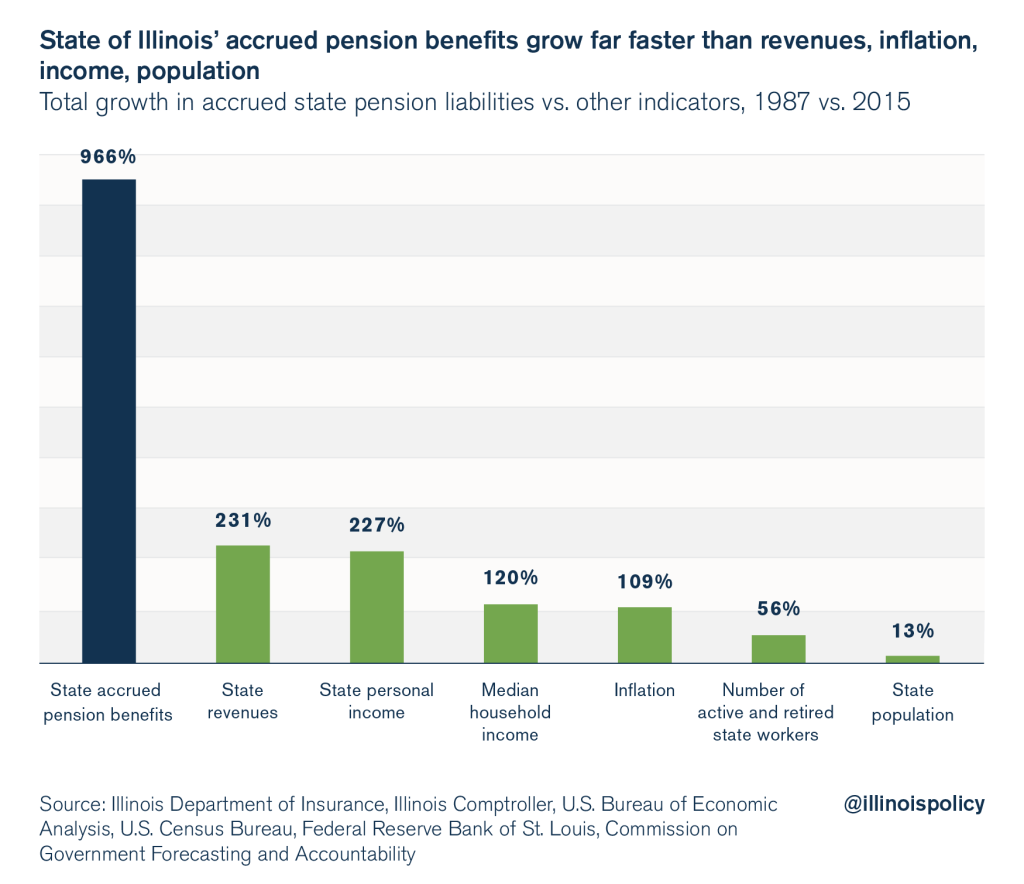

Critics have constantly blamed underfunding as the cause of Illinois’ pension crisis. But the real pension problem has been the dramatic growth in benefits granted to government workers by politicians over the past three decades.

Benefit costs have risen so drastically that no amount of taxpayer dollars could have kept up with them.

The total benefits owed to workers and retirees (accrued liabilities) have grown nearly 1,000 percent, or nearly 11-fold since 1987. In contrast, the economy (state income) has only grown 227 percent; inflation, just 109 percent; and the actual number of participants in the pension systems has grown only 56 percent. The state’s population has increased just 13 percent over that period.

Pension benefits have grown far faster than any of those factors.

To understand how massive that growth in benefits is, consider that the median Illinois household income in 1987 was $27,000.

If household incomes had grown at the same rate as accrued pension benefits – 9 percent each year – households today would be making nearly $290,000 a year instead of the $60,400 they take in now.

- Pensions crowd out funding for social programs and other core services

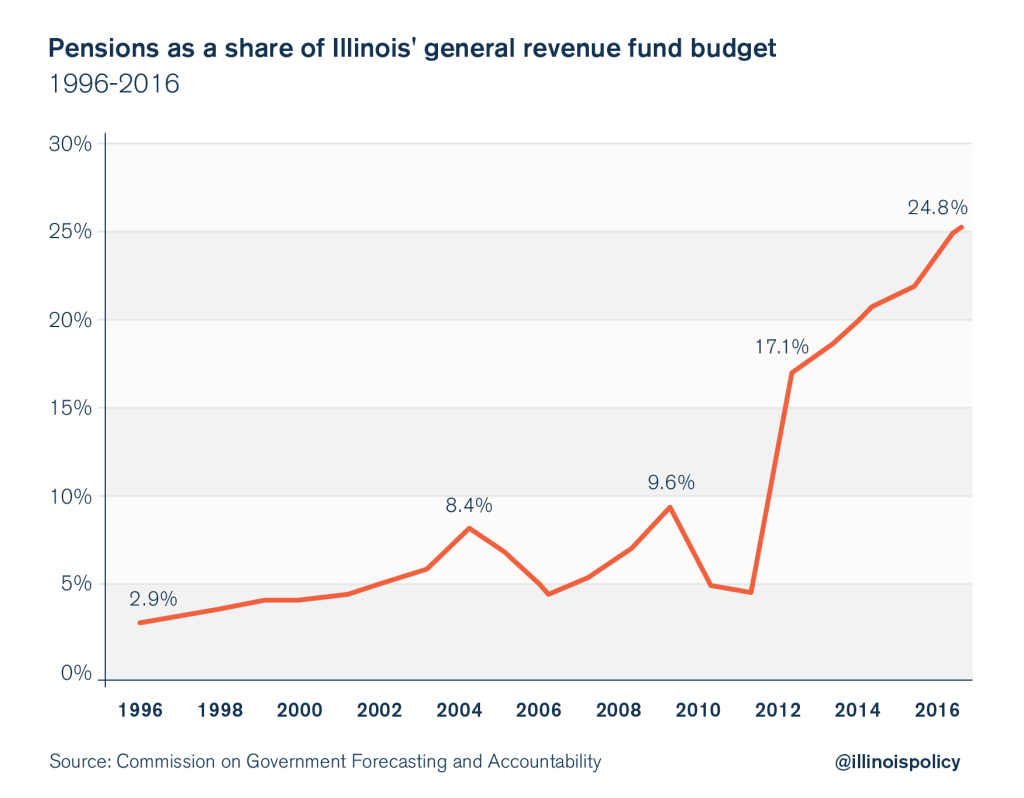

Yearly pension costs now consume 25 percent of the state’s general fund budget and are crowding out spending on social services, higher education and nearly every other core government service.

Pension contributions have grown to over $7 billion annually, up $6 billion from the year 2000. Even a small portion of that money could be enough to fund home health care workers and services for those with mental disabilities.

Instead, Taxpayers have been forced to pour additional dollars into the broken pension system over the past few years, even as the state’s pension funds have grown closer and closer to bankruptcy.

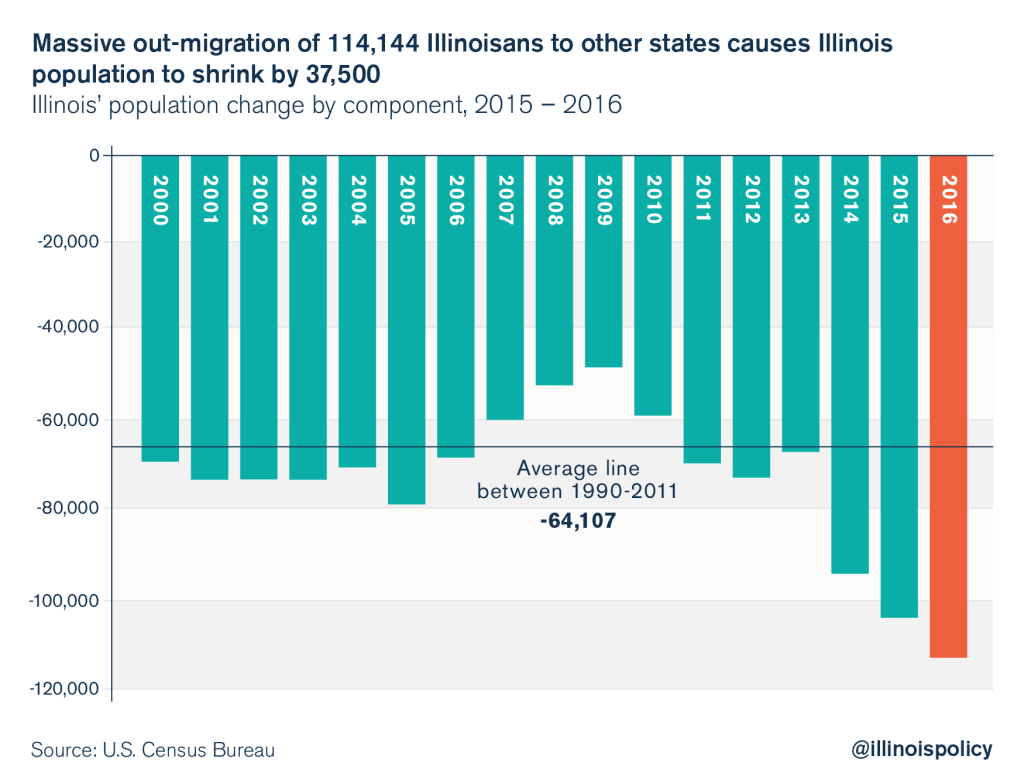

- All these crises result in an exodus of Illinoisans and an eroding tax base

A net 1.2 million people have fled Illinois over the past decade and a half – the worst out-migration record in the Midwest and one of the worst records of any state in the country. In 2016, Illinois lost 114,000 people, on net, to other states, a record high for the Land of Lincoln.

And the income of those moving out of Illinois continues to surpass the income of those moving into Illinois. Overall, Illinois has lost more than $40 billion dollars in taxable income due to out-migration since 2000, resulting in permanent harm to Illinois’ tax base.